Pay it forward.

Give back the privilege

by helping others.

Be a man for others.

Pay it forward.

Give back the

privilege by

helping others.

Be a man for others.

- John L. Gokongwei, Jr.

Board of Directors

John L. Gokongwei, Jr. †

Chairman Emeritus & Director

Lance Y. Gokongwei

Chairman

James L. Go

Vice Chairman

Robina Y. Gokongwei-Pe

President, Chief Executive Officer & Director

Faith Y. Gokongwei-Lim

Director

Ian James Winward Mcleod

Director

Kim Samuel Sanghyun

Director

Antonio L. Go

Independent Director

Roberto R. Romulo

Independent Director

Business Unit Heads

Senior Management

| Robina Y. Gokongwei-Pe | Director, President and Chief Executive Officer |

| Cornelio S. Mapa | Senior Vice President and Chief Strategy Officer |

| Mylene A. Kasiban | Chief Financial Officer |

| Atty. Rosalinda F. Rivera | Corporate Secretary |

| Atty. Gilbert S. Millado, Jr. | Assistant Corporate Secretary, General Counsel, and Data Privacy Officer |

| Graciela A. Banatao | Treasurer |

| Justiniano S. Gadia | Managing Director- Supermarket Segment |

| Celina N. Chua | Group General Manager – Robinsons Department Store and Toys ‘R’ Us |

| Wilfred T. Co | Vice Chairman – Handyman Do it Best |

| Stanley C. Co | Group General Manager – Handyman Do it Best, True Value, Robinsons Builders, Daiso Japan, Arcova, Super 50 and Pet Lovers Centre |

| Jose Paulo R. Lazaro | General Manager – Robinsons Builders |

| David Goh | Managing Director – Ministop, Southstar, and TGP |

| Faith Y. Gokongwei-Lim | General Manager – Chic Centre Corporation |

| Jovito U. Santos | Group General Manager – Robinsons Appliances and Savers Appliances |

| Jaime J. Uy | Managing Director- Savers Appliances |

| Maria Carmina Pia G. Quizon | General Manager – Specialty Fashion & Beauty |

| Katherine Michelle Q. Yu | General Manager – Daiso Japan, Arcova and Super 50 |

| Christine O. Tueres | General Manager – Southstar Drug |

| Benjamin I. Liuson | Vice Chairman – TGP |

| Agnes G. Rafiñan | General Manager – TGP |

| Manuel T. Dy | Senior Vice President, Business Development – Southstar Drug and TGP |

| Paz Regina A. Salgado | Vice President, Robinsons Department Store Business Center |

| Patricia Ann C. Famador | Assistant Vice President, Loyalty and Financial Products Division |

| Mark O. Tansiongkun | Vice President, Procurement and Administration |

| Stephen M. Yap | Vice President, Chief Information Officer |

| Gabriel D. Tagala III | Vice President, Human Resources |

| Gina Roa-Dipaling | Vice President, Corporate Planning, Investor Relations Officer and Sustainability Head |

Corporate Governance

Robinsons Retail Holdings, Inc. (“The Company”) acknowledges that good corporate governance is essential to build an environment of trust, transparency and accountability necessary for fostering long-term performance, financial stability, business integrity and sustainability of the company for the protection of the interests of shareholders and other stakeholders.

Corporate governance is the framework of rules, systems and processes of the corporation that governs the performance by the Board of Directors and Management of their respective duties and responsibilities to the stakeholders. The Revised Corporate Governance Manual was adopted to institutionalize corporate governance principles as a guide for the daily conduct of business.

The Company believes that sound and effective corporate practices are fundamental to the smooth, effective and transparent operation of the company, its ability to attract investment and enhance shareholder value. This includes the Company’s commitment to ensure fair and equitable treatment of all shareholders, including the minority, and the protection of their rights that include:

- Right to vote on all matters that require their consent or approval

- Right to inspect corporate books and records

- Right to information

- Right to dividends

- Appraisal right

Guided by the principles of fairness, accountability and transparency to the shareholding public, the Company ensures that the result of the votes taken during the most recent Annual or Special Shareholders’ Meeting are made available the next working day. In addition, the Minutes of the Annual and Special Shareholders’ Meeting may be accessed through the Company Website within five (5) business days from the end of the meeting.

The Company recognizes and places importance on the interdependence between business and society, and promote a mutually beneficial relationship that encourages the Company’s sustainable growth, while contributing to the advancement of the society where it operates. The Company employs value chain processes that take into consideration Economic, Environmental and Social Governance (EESG) issues and concerns.

Customers’ Welfare

The Company adopts customer relations policies and procedures to protect customer’s welfare. This includes providing and making available the customer relations contact information who is empowered to address and attend to customer questions and concerns.

Supplier/Contractor Selection

The Company follows the Supplier Accreditation Policy to ensure that the Company’s suppliers and contractors are qualified to meet its commitments. Apart from the accreditation process, suppliers and contractors also undergo orientation on Company policies and ethical practices.

Employees

The Board also establishes policies, programs and procedures that encourage employees to actively participate in the realization of the Company’s goals and its governance including but not limited to:

- Health, safety and welfare;

- Training and development; and

- Reward and compensation.

1.Performance-enhancing mechanisms for employee participation

The Company abides by the standards and policies set by the Department of Labor and Employment. Likewise, the Company has Security and Safety Manuals that are implemented, reviewed and regularly updated to ensure the security, safety, health, and welfare of the employees in the workplace.

The Company continuously provides learning and development opportunities for its employees through the Robinsons Retail Academy (RRA), the leadership platform for systematic and sustained development programs across the conglomerate. Its mission is to enable a high performing organization that will facilitate the learning process and develop the intellectual and personal growth of all employees through targeted and customized trainings and development programs.

2.Anti-corruption programs and procedures

The Company is committed to promoting transparency and fairness to all stakeholders. The Board sets the tone and make a stand against corrupt practices by adopting anti corruption policies and programs. Some of the Company’s Anti-Corruption programs are embodied in the Code of Business Conduct and Ethics, Conflict of Interest, Offenses Subject to Disciplinary Action (OSDA), among others. The same are disseminated to all employees across the Company through trainings to embed them in the Company’s culture. New employees are oriented regarding policies and procedures related to Business Conduct and Ethics and similar policies. All employees are given periodic reminders. Further, all concerned employees of the Conglomerate are required to comply with the Self-Disclosure Activity on Conflict of Interest and Declaration of Gifts Received on an annual basis.

The Company also has an established suitable framework for whistleblowing and ensure its enforcement to allow employees and other stakeholders to freely communicate their concerns about illegal or unethical practices without fear of retaliation, and to have direct access to an independent member of the Board or a unit created to handle whistleblowing concerns.

The anti-corruption programs and procedures of the Company are summarized below:

| Business Conduct & Ethics | Policy Statement |

|---|---|

| Conflict of Interest | The Company’s Code of Business Conduct and Conflict of Interest Policy require employees to make a conscious effort to avoid conflict of interest situations; that his judgment and discretion are not influenced by considerations of personal gain or benefit. A conflict of interest may also occur because of the actions, employment, or investments of an immediate family member of an employee. |

| Conduct of Business and Fair Dealings | The Company’s employees who recommend, endorse, or approve the procurement or sale of goods and services should make a conscious effort to avoid any conflict of interest situation in transactions they are involved in. |

| Receipt of Gifts from Third Parties | The Company discourages the acceptance of gifts. However, gifts like advertising novelties may be given or accepted during the Christmas season. There is no restriction in the value of the gift that may be accepted. However, accepted gift with estimated value over Php2,000.00 must be disclosed to the Conflicts of Interest Committee. |

| Compliance with Laws and Regulations | The Company ensures that all transactions comply with relevant laws and regulations. Any deficiencies are immediately rectified. |

| Respect for Trade Secrets/Use of Non- public Information | The Company has policies that ensure proper and authorized disclosure of confidential information. Disclosures to the public can only be done after the disclosure to SEC and PSE by the Company’s authorized officers. |

| Use of Company Funds, Assets and Information | Employees are required to safeguard Company resources and assets with honesty and integrity. Employees must ensure that these assets are efficiently, effectively, and responsibly utilized. |

| Employment and Labor Laws and Policies | The Company ensures the observance, strict implementation and compliance with employment and labor laws and policies with regards to recruitment, employment, retention and benefits of the employees. |

| Disciplinary Action | Violation of any provision of the Code of Business Conduct may result to disciplinary action, including dismissal and reimbursement for any loss to the Company that resulted from the employee’s actions. If appropriate, a violation may result in legal action against the employee or referral to the appropriate government authorities. |

| Whistleblowing | The stakeholders may discuss or disclose in writing any concern on potential violation of the Code of Business Conduct with the Conflicts of Interest Committee. Reports or disclosures can be made in writing or by email using the following contact details: a. email address cicom@robinsonsretail.com.ph b. fax number 8395-3888 c. mailing address Must be sent in a sealed envelope clearly marked “Strictly Private and Confidential-To Be Opened by Addressee Only” CICOM 40th Flr. Robinsons Equitable Tower ADB Avenue, Cor., Poveda Road, Pasig City The complaint shall be filed using the Complaint/Disclosure Form (CDF) available in the company website. All information received in connection with the reports or disclosures shall be strictly confidential and shall not be disclosed to any person without prior consent of CICOM. The Company commits to protect those who report in good faith from retaliation, harassment and even informal pressures. It will take the necessary and appropriate action to do so in enforcing the policy. |

| Conflict Resolution | The Conflicts of Interest Committee submits recommendations on courses of action to be taken on conflicts of interest situations. The decision is done by the Executive Committee. |

Corporate Governance

Highlights

Consistent with the Revised Corporate Governance Manual and pursuant to the recommendations provided in the Code of Corporate Governance for Publicly Listed Companies (PLCs), the Company strengthened its policies on Board Diversity, Board Trading and Election, Succession Planning and Remuneration, Material Related Party Transactions, Insider Tradings, and Whistleblowing to reinforce the governance framework of the Company.

These policies may be accessed in the Company’s website, in the Governance section, https://www.robinsonsretailholdings.com.ph/corporate-governance/manual-1

The Company submitted the Integrated Corporate Governance Report (I-ACGR) to the Securities and Exchange Commission (SEC) and Philippine Stock Exchange (PSE) on May 30, 2019. The I-ACGR is a reportorial requirement under SEC Memorandum Circular No. 15 series of 2017 to all PLCs to disclose the Company’s compliance/non-compliance with the recommendations provided under the Corporate Governance Code for PLCs. With the “comply or explain” approach, voluntary compliance to recommended CG best practices is combined with mandatory disclosure. The Company also submitted the Material Related Party Transactions (MRPT) Policy to SEC as required under SEC Memorandum Circular No. 10 series of 2019.

The Company’s I-ACGR may be accessed through the Company website by clicking this link, https://www.robinsonsretailholdings.com.ph/corporate-governance/I-ACGR

THE BOARD OF DIRECTORS

The Board of Directors (“The Board”) is primarily responsible for the governance of the Company and provides an independent check on management. It has the duty to foster the long-term success of the Company and to ensure that the Company’s competitiveness and profitability will be sustained in a manner consistent with its corporate objectives for the best interest of the company and its stakeholders.

The Board formulates the Company’s vision, mission, strategic objectives, policies and procedures that guide its activities, including the means to effectively monitor Management’s performance. It provides direction and approval in relation to matters concerning the Company’s business strategies, policies and plans, while the day-to-day business operations are delegated to the Executive Committee.

The Board exercises care, skill and judgment and observes good faith and loyalty in the conduct and management of the business and affairs of the Company. It ensures that all its actions are within the scope of power and authority as prescribed in the Articles of Incorporation, By-Laws, and existing laws, rules and regulations. To uphold high standard for the Company, its Shareholders and other Stakeholders, the Board conducts itself with honesty and integrity in the performance of its duties and responsibilities.

Board Duties and Responsibilities

The Company’s Corporate Governance Manual specifies the roles, duties and responsibilities of the Board of Directors in compliance with relevant laws, rules and regulations. In adherence to the principles of corporate governance, the Board is tasked to perform the following:

General Responsibilities

It is the Board’s responsibility to foster the long-term success of the Corporation, and to sustain its competitiveness and profitability in a manner consistent with its corporate objectives and in the best interest of the Corporation, its Shareholders and Stakeholders, as a whole.

Duties and Functions

To ensure high standard for the Corporation, its Shareholders and other Stakeholders, the Board shall conduct itself with honesty and integrity in the performance of, among others, the following duties and responsibilities:

- Act on a fully informed basis, in good faith, with due diligence and care, and in the best interest of the Company and all Stakeholders;

- Oversee the development of and approve the Company’s business objectives and strategy, and monitor their implementation, in order to sustain the Company’s long-term viability and strength. The Board shall review and guide corporate strategy, major plans of action, risk management policies and procedures, annual budgets and business plans; set performance objectives; monitor implementation and corporate performance; and oversee major capital expenditures, acquisitions and divestitures;

- Oversee the adoption of an effective succession planning program and remuneration policies;

- Adopt policies on board nomination and election that will ensure diversity in board composition in terms of knowledge, expertise and experience;

- Oversee the implementation of a policy and system on RPTs which

shall include the review and approval of material or significant RPTs and ensure fairness and transparency of the transactions; - Oversee the adoption of policies on the selection of Management and Key Officers and the assessment of their performance;

- Oversee the establishment of an internal control system to monitor and manage potential conflicts of interest and an ERM framework to identify, monitor, assess and manage key business risks;

- Annually review, together with Management, the Company’s vision and mission;

- Ensure the Corporation’s faithful compliance with all applicable laws and regulations, and best business practices;

- Establish and maintain an Investor Relations Program that will keep the Shareholders informed of important developments in the Corporation. The Corporation’s CEO shall exercise oversight responsibility over this program;

Identify the Corporation’s Stakeholders in the community in which it operates or are directly affected by its operations and formulate a clear policy of accurate, timely, and effective communication with them;

Adopt a system of check and balance within the Board. A regular review of the effectiveness of such system should be conducted to ensure the integrity of the decision- making and reporting processes at all times; - Ensure that the Corporation has an independent audit mechanism for the proper audit and review of the Corporation’s financial statements by independent auditors;

- Ensure that the Corporation establishes appropriate Corporate Governance policies and procedures pursuant to this Manual and the Governance Code, including but not limited to, policies on conflict of interest, and oversee the effective implementation thereof; and

- Consider the implementation of an alternative dispute resolution system for the amicable settlement of conflicts or differences between the Corporation and its Shareholders, if applicable.

Balanced board composition

The Company recognizes the benefits of having a diverse Board and its value in maintaining sound corporate governance while achieving strategic objectives and sustainable growth. The Board Member’s biographical details can be found in the Information Statement. The Board is diverse in terms of expertise, gender and professional experience. The Board has 2 women forming part of the Board. Furthermore, the posts of Chairman and Chief Executive Officer of the Company are separate to ensure a clear distinction between the Chairman’s responsibility to manage the Board and the Chief Executive Officer’s responsibility to manage the Company’s business. The division of responsibilities between the Chairman and the Chief Executive Officer is clearly established and set out in the Revised Corporate Governance Manual.

Board Independence

The Board has two independent directors that possess all the necessary qualifications and none of the disqualifications to hold the position. The Company reinforce proper mechanisms for disclosure, protection of the rights of shareholders, equitable treatment of shareholders, and the accountability of the Board and Management are in place. In cases of conflicts of interest, Directors with a material interest in any transaction with the Company abstain from participating in the deliberation of the same.

Board Training and

Orientation

The Company ensures that directors are able to perform their functions effectively in this rapidly changing environment to cope with heightened regulatory policies, foreign and local demands, and the growing complexity of the business. Orientation programs are conducted for first-time directors to ensure that new members are appropriately apprised of their duties and responsibilities. This includes overview of the Company’s operations, Code of Conduct, Corporate Governance framework and other relevant topics essential in the performance of their functions. As a matter of continuous professional education, the Company facilitates the training opportunities provided for the Directors and Key Officers.

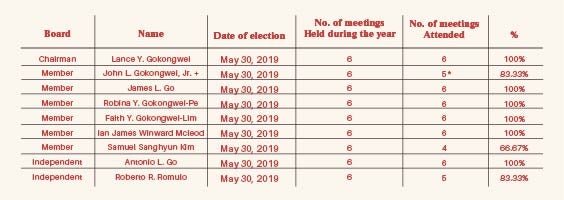

Board Meetings

The Board schedules meetings at the beginning of the year, holds regular meetings in accordance with its By-Laws and convene special meetings when required by business exigencies. The notice and agenda of the meeting and other relevant meeting materials are furnished to the Directors at least five (5) business days prior to each meeting. Meetings are duly minuted. The Independent Directors shall always attend Board meetings. Unless otherwise provided in the By-Laws, their absence shall not affect the quorum requirement. However, the Board may, to promote transparency, require the presence of at least one (1) Independent Director in all its meetings.

To monitor the Directors’ compliance with the attendance requirements, the Company submits to the Commission an advisement letter on the Directors’ record of attendance in Board meetings.

Attendance of Directors

| Board | Name | Date of election | No. of meetings Held during the year | No. of meetings Attended | % |

| Director | John L. Gokongwei, Jr. + | May 30, 2019 | 6 | 5* | 83.33% |

| Director, Chairman | Lance Y. Gokongwei | May 30, 2019 | 6 | 6 | 100% |

| Director, Vice-Chairman | James L. Go | May 30, 2019 | 6 | 6 | 100% |

| Director, President and CEO | Robina Y. Gokongwei-Pe | May 30, 2019 | 6 | 6 | 100% |

| Director | Faith Y. Gokongwei-Lim | May 30, 2019 | 6 | 6 | 100% |

| Director | Ian James Winward Mcleod | May 30, 2019 | 6 | 6 | 100% |

| Director | Samuel Sanghyun Kim | May 30, 2019 | 6 | 4 | 66.67% |

| Independent Director | Antonio L. Go | May 30, 2019 | 6 | 6 | 100% |

| Independent Director | Roberto R. Romulo | May 30, 2019 | 6 | 5 | 83.33% |

The Board Committees

To enable better and more focused attention on the affairs of the Company and aid in the optimal performance of its roles and responsibilities, the Board delegates particular matters to the Board Committees set up for the purpose mainly (a) Audit Committee, (b) Corporate Governance Committee and (c) Board Risk Oversight Committee (BROC).

A. Audit Committee

The Audit Committee provides oversight over the Company’s financial reporting, Internal Control System, Internal and External Audit processes, and monitor compliance with applicable laws and regulations. It ensures that systems and processes are put in place to provide assurance in areas including reporting, monitoring compliance with laws, regulations and internal policies, efficiency and effectiveness of business operations, and proper safeguarding and use of the Company’s resources and assets.

| Position | Director |

| Chairman | Antonio L. Go (ID) |

| Member | James L. Go Lance Y. Gokongwei Robina Y. Gokongwei-Pe Samuel Sanghyun Kim Roberto R. Romulo |

B. Corporate Governance Committee

The Corporate Governance Committee oversees the development and implementation of Corporate Governance principles and policies and recommends a formal framework on the nomination, remuneration and evaluation of the performance of the Directors and key Management Officers consistent with the Company’s culture, strategies and the business environment.

| Position | Director |

| Chairman | Robina Y. Gokongwei-Pe |

| Members | Antonio L. Go Roberto R. Romulo |

C. Board Risk Oversight Committee

The Board Risk Oversight Committee oversees the establishment of ERM framework that effectively identify, monitor, assess and manage key business risks and assess the effectiveness of risk management strategies. The BROC is responsible for defining the Company’s level of risk tolerance and providing oversight over its risk management policies and procedures to anticipate, minimize, control or manage risks or possible threats to its operational and financial viability.

| Position | Director |

| Chairman | Lance Y. Gokongwei |

| Members | Robina Y. Gokongwei-Pe Antonio L. Go Roberto R. Romulo |

D. Remuneration Committee

The Remuneration Committee objectively recommends a formal and transparent framework of remuneration and evaluation for Directors and key Management Officers to ensure that their compensation is consistent with the Corporation’s culture, strategies and the business environment in which it operates and to enable them to run the Corporation successfully.

| Position | Director |

| Members | James L. Go Lance Y. Gokongwei Robina Y. Gokongwei-Pe Antonio L. Go Ian James Winward Mcleod |

The Corporate Secretary

The Corporate Secretary assists the Board and the Board Committees in the conduct of their meetings, including preparation of the annual schedule of Board and Committee meetings and the annual Board calendar. She also assists the Board Chairs and its Committees in setting agendas for the meetings, safekeeps and preserves the integrity of the minutes of the meeting of the Board and its Committees, as well as other official records of the Company.

The Corporate Secretary keeps herself abreast on relevant laws, regulations, all governance issuances, relevant industry developments and operations of the Company, and advice the Board and the Chairman on all relevant issues as they arise. She works fairly and objectively with the Board, Management and Shareholders and contributes to the flow of information between the Board and Management, the Board and its Committees, and the Board and its Stakeholders, including Shareholders.

Atty. Rosalinda F. Rivera is the current Corporate Secretary of the Company. She is also the Corporate Secretary of JG Summit Holdings, Inc., Universal Robina Corporation, Robinsons Land Corporation, Cebu Air, Inc., JG Summit Petrochemical Corporation, and JG Summit Olefins Corporation.

Prior to joining the Company, she was a Senior Associate as Puno and Puno Law Offices. She received a degree of Juris Doctor from the Ateneo de Manila University School of Law and a Masters of Law degree in International Banking from the Boston University School of Law.

The Compliance Officer

The Compliance Officer monitors, reviews, evaluates and ensures the compliance by the Company; its Officers and Directors with the provisions and requirements of the Corporate Governance Manual and the relevant laws, the Corporate Governance Code, rules and regulations and all governance issuances of regulatory agencies. He also ensures the integrity and accuracy of all documentary submissions to the regulators; identifies possible areas of compliance issues and works towards the resolution of the same. He assists the Board and the Corporate Governance Committee in the performance of their governance functions, including their duties to oversee the formulation or review and implementation of the Corporate Governance structure and policies of the Company.

Cornelio S. Mapa, Jr. is the current Compliance Officer and Senior Vice President, Chief Strategy Officer of the Company. He also serves as SVP- Investments and New Builds for JG Summit Holdings, Inc. He was previously the Executive Vice President & Managing Director of Universal Robina Corporation (URC). Prior to URC, he was Executive Vice President and BU-GM of the Commercial Centers Division of Robinsons Land Corporation, He also previously held the position of Chief Financial Officer & Senior Vice President at Coca Cola Bottlers Phils, Inc., including its subsidiaries Philippine Beverage Partners, Inc. and Cosmos Bottling Corp. Concurrently he served the same capacity at La Tondeña Distillers, Inc.

He received his undergraduate degree from New York University and MBA from the International Institute for Management Development.

ENTERPRISE RISK MANAGEMENT,

ACCOUNTABILITY AND AUDIT

The Company recognizes the increasing importance of sound risk management practices to drive business growth and sustainability. The Company implemented systems and processes to facilitate proper risk identification, monitoring and control, which are key to effective corporate governance. Timely and accurate management and financial reporting systems, internal controls, and audits are also employed to protect and maximize stakeholders’ value.

The Board oversees Management’s adoption and implementation of a sound risk management framework for identifying, monitoring and managing key risk areas. The BOD reviews Management reports with due diligence to enable the company to anticipate, minimize, control and manage risks or possible threats to its operational and financial viability.

Enterprise Risk Management

Through a sound Enterprise Risk Management (ERM) framework, the Company effectively identifies, monitors, assesses and manages key business risks. The framework guides the Board in identifying units/business lines and enterprise level risk exposures, as well as the effectiveness of risk management strategies.

The ERM framework revolves around the following eight interrelated risk management approaches:

1. Internal Environmental Scanning – it involves the review of the overall prevailing risk profile of the Business Unit (BU) to determine how risks are viewed and addressed by the management. This is presented during the strategic planning, annual budgeting and mid-year performance reviews of the BU.

2. Objective Setting – the Company’s Board mandates Management to set the overall annual targets through strategic planning activities, in order to ensure that management has a process in place to set objectives that are aligned with the Company’s goals.

3. Event Identification – it identifies both internal and external events affecting the Group’s set targets, distinguishing between risks and opportunities.

4. Risk Assessment – the identified risks are analyzed relative to the probability and severity of potential loss that serves as basis for determining how the risks will be managed. The risks are further assessed as to which risks are controllable and uncontrollable, risks that require management’s action or monitoring, and risks that may materially weaken the Company’s earnings and capital.

5. Risk Response – the Company’s Board, through the oversight role of the Internal Control Group ensures action plan is executed to mitigate risks, either to avoid, self-insure, reduce, transfer or share risk.

6. Control Activities – policies and procedures are established and approved by the Company’s Board and implemented to ensure that the risk responses are effectively carried out enterprise- wide.

7. Information and Communication – relevant risk management information is identified, captured and communicated in form and substance that enable all personnel to perform their risk management roles.

8. Monitoring – the Internal Control Group of the respective Company and BUs and Corporate Internal Audit constantly monitor the management of risks through audit reviews, compliance checks, revalidation of risk strategies and performance reviews.

Risk Assessment Tool

To help Business Units in the Risk Assessment Process, the Risk Assessment Tool, which is a database driven web application, was developed for departments and units to facilitate the assessment, monitoring and management of risks.

The Risk Assessment Tool documents the following activities:

1.Risk Identification – is the critical step of the risk management process. The objective of risk identification is the early identification of events that may have negative impact on the Company’s ability to achieve its goals and objectives.

1.1. Risk Indicator – is a potential event or action that may prevent the continuity of operation or business

1.2. Risk Driver – is an event or action that triggers the risk to materialize

1.3. Value Creation Opportunities – is the positive benefit of addressing or managing the risk

2. Identification of Existing Control Measures – activities, actions or measures already in place to control, prevent or manage the risk.

3. Risk Rating/Score – is the quantification of the likelihood and impact to the Company if the risk materializes. The rating has two (2) components:

3.1. Probability – the likelihood of occurrence of risk

3.2. Severity – the magnitude of the consequence of risk

4. Risk Management Strategy – is the structured and coherent approach to managing the identified risk.

5. Risk Mitigation Action Plan – is the overall approach to reduce the risk impact severity and/or probability of occurrence.

Results of the Risk Assessment Process is summarized in a Dashboard that highlights the risks that require urgent actions and mitigation plan. The dashboard helps Management to monitor, manage and decide a risk strategy and needed action plan.

Internal Controls

With the leadership of the Company’s Chief Financial Officer (CFO), internal control is embedded in the operations of the company and in each BU thus increasing their accountability and ownership in the execution of the BU’s internal control framework. To accomplish the established goals and objectives, BUs implement robust and efficient process controls to ensure:

1. Compliance with policies, procedures, laws and regulations

2. Economic and efficient use of resources

3. Check and balance and proper segregation of duties

4. Identification and remediation control weaknesses

5. Reliability and integrity of information

6. Proper safeguarding of company resources and protection of company assets through early detection and prevention of fraud.

Adequate and Timely Information

To enable the Directors to properly fulfill their duties and responsibilities, Management provides the Directors with complete, adequate, and timely information about the matters to be taken up in their meetings. Information may include the background or explanation on matters brought before the Board, disclosures, budgets, forecasts, and internal financial documents. If the information provided by Management is not sufficient, further inquiries may be made by a Director to enable him to properly perform his duties and responsibilities. The Directors have independent access to Management and to the Corporate Secretary.

The Directors, either individually or as a Board, and in the performance of their duties and responsibilities, may seek access to independent professional advice within the guidelines set by the Board.

Accountability and Audit

The Board ensures that its Shareholders are provided with a balanced and comprehensible assessment of the Company’s performance, position and prospects on a quarterly basis. Interim and other reports that could adversely affect its business are also made available in the Company website including its submissions and disclosures to the SEC and PSE.

Management formulates the rules and procedures on financial reporting and internal control for presentation to the Audit Committee in accordance with the following guidelines:

1. The extent of its responsibility in the preparation of the financial statements of the Company, with the corresponding delineation of the responsibilities that pertain to the External Auditor, should be clearly defined;

2. An effective system of internal control that will ensure the integrity of the financial reports and protection of the assets of the Company for the benefit of all Shareholders and other Stakeholders;

3. On the basis of the approved Internal Audit Plan, Internal Audit examinations should cover, at the minimum, the evaluation of the adequacy and effectiveness of controls that cover the Company’s governance, operations and information systems, including the reliability and integrity of financial and operation information, effectiveness and efficiency of operations, protection of assets, and compliance with contracts, laws, rules, and regulations;

4. The Company consistently complies with the financial reporting requirements of the SEC;

5. The External Auditor shall be rotated or changed every five (5) years or earlier, or the signing partner of the External Auditing firm assigned to the Company, should be changed with the same frequency. The Corporate IA Head should submit to the Audit Committee and Management an annual report on the Internal Audit department’s activities, responsibilities, and performance relative to the Internal Audit Plan as approved by the Audit and Risk Committee. The annual report should include significant risk exposures, control issues, and such other matters as may be needed or requested by the Board and Management. The Internal Audit Head should certify that he conducts his activities in accordance with the International Standards on the Professional Practice of Internal Auditing. If he does not, the Internal Audit Head shall disclose to the Board and Management the reasons why he has not fully complied with the said documents; and

6. The Board, after consultations with the Audit Committee shall recommend to the Shareholders an External Auditor duly accredited by the SEC who shall undertake an independent audit of the Company, and shall provide an objective assurance on the matter by which the financial statements shall be prepared and presented to the Shareholders.

Internal Audit

The Corporate Internal Audit is focused on delivering its mandate of determining whether the governance, risk management and control processes, as designed and represented by management, are adequate and functioning in a manner that provides reasonable level of confidence that:

1. Employees’ actions are compliant with policies, standards, procedures, and applicable laws and regulations;

2. Quality and continuous improvement are fostered in the control processes;

3. Programs, plans, and objectives are achieved;

4. Resources are acquired economically, used efficiently, and protected adequately;

5. Significant financial, managerial, and operating information is accurate, reliable, and timely;

6. Significant key risks are appropriately identified and managed; and

7. Significant legislative or regulatory issues impacting the Company are recognized and properly addressed.

Opportunities for improving management control, profitability and the Company’s reputation may be identified during audits.

Other Matters

Audit and Audit-Related Fees

| Name of Auditor | Audit Fee | Non-Audit Fee |

| SyCip, Gorres, Velayo & Co. | Php 8,788,422 | Php 370,370 |

Ownership Structure

Holding 5% shareholding or more (as of December 31, 2019)

| Shareholder | No. of Shares | Percent | Beneficial Owner |

| JE Holdings, Inc. | 484,749,997 | 30.75% | Same as record owner |

| PCD Nominee Corporation (Non- Filipino) | 383,594,050 | 24.33% | PCD Participants & their clients |

| PCD Nominee Corporation (Filipino) | 195,238,734 | 12.38% | PCD Participants & their clients |

| Mulgrave Corporation B.V. | 191,489,360 | 12.15% | Same as record owner |

| Lance Y. Gokongwei | 107,538,351 | 6.82% | Same as record owner |

| Robina Y. Gokongwei-Pe | 89,779,346 | 5.69% | Same as record owner |

Dealing in securities (changes in shareholdings of directors and key officers)

| Name of Director | No. of Shares | % to Total Outstanding Shares |

| John L. Gokongwei, Jr.+ | 0 | 0 |

| Lance Y. Gokongwei | 107,538,351 | 6.82% |

| Robina Y. Gokongwei-Pe | 89,906,846 | 5.70% |

| James L. Go | 31,928,005 | 2.03% |

| Faith Y. Gokongwei-Lim | 29,968,949 | 1.90% |

| Ian James Winward McLeod | 1 | 0% |

| Samuel Sanghyun Kim | 1 | 0% |

| Antonio L. Go | 1 | 0% |

| Roberto R. Romulo | 1 | 0% |

Note: Mr. John L. Gokongwei, Jr. passed away on November 9, 2019.

| Name of Officer | Position/ Designation |

Numbers of Direct Shares | % to Total Outstanding Shares |

| Cornelio S. Mapa, Jr. | Senior Vice President, Chief Strategy Officer and Compliance Officer | 0 | 0% |

| Mylene A. Kasiban | Chief Financial Officer | 0 | 0% |

| Graciela A. Banatao | Treasurer | 0 | 0% |

| Gabriel Tagal III | Vice President, Human Resources | 0 | 0% |

| Rosalinda F. Rivera | Corporate Secretary | 0 | 0% |

| Gilbert S. Millado, Jr. | Assistant Corporate Secretary and General Counsel | 500 | 0% |

| Gina R. Dipaling | Vice President, Corporate Planning and Investor Relations Officer | 1,500 | 0% |

Dividends

The Board of Directors of Robinsons Retail Holdings, Inc. (“RRHI”) approved on May 30, 2019 the declaration of a cash dividend in the amount of Seventy Two Centavos (P0.72) per share from the unrestricted retained earnings of RRHI as of December 31, 2018 to all stockholders of record as of June 20, 2019 and paid on July 12, 2019.

Company Website

The Company updates the public with operating and financial results

through timely disclosures filed with SEC and PSE. These are available on

the company’s website: https://www.robinsonsretailholdings.com.ph/