Financial

Highlights

In PHP Millions

At Year-end (In Php Millions)

Per Share*

I discovered that

opportunities don't find you;

you find your opportunities

I discovered

that opportunities

don't find you;

you find your

opportunities

- John L. Gokongwei, Jr.

Management's

Discussion & Analysis

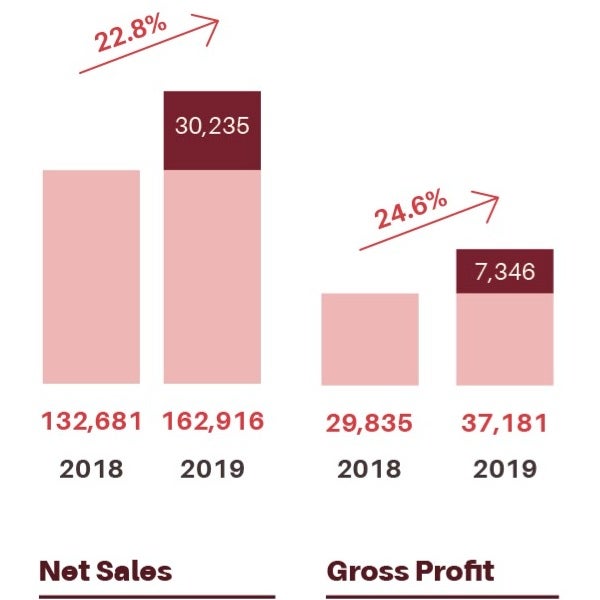

Robinsons Retail Holdings, Inc. recorded an increase of 22.8% in consolidated net sales to Php162.9 billion in 2019. The strong growth was primarily driven by the robust same store sales growth (SSSG) of 3.4%, additional sales coming from new stores opened from January to December 2019, and the full-year consolidation of Rustan Supercenters, Inc. (Rustan), whichwas acquired on November 23, 2018.

Blended SSSG for 2019 was healthy at 3.4% and at the higher end of the 2%-4% SSSG target, mainly driven by the strong performance of drugstore at 9.9%, supermarkets at 3.6% and convenience store at 3.2%. All segments registered positive SSSG despite coming from a high base of 5.9% last year due to the impact of Tax Reform for Acceleration and Inclusion Law (TRAIN).

Gross profit margin improved by 30 basis points (bps) to 22.8% attributable to the larger scale, improvement in category mix in most segments and the full-year consolidation of the higher margin Rustan business.

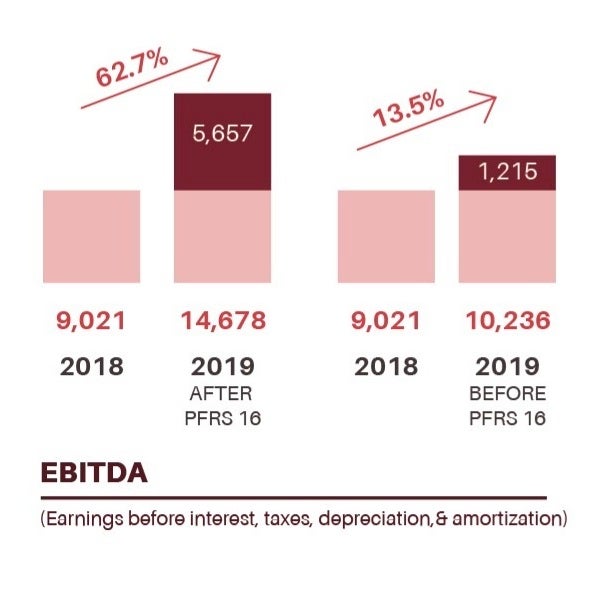

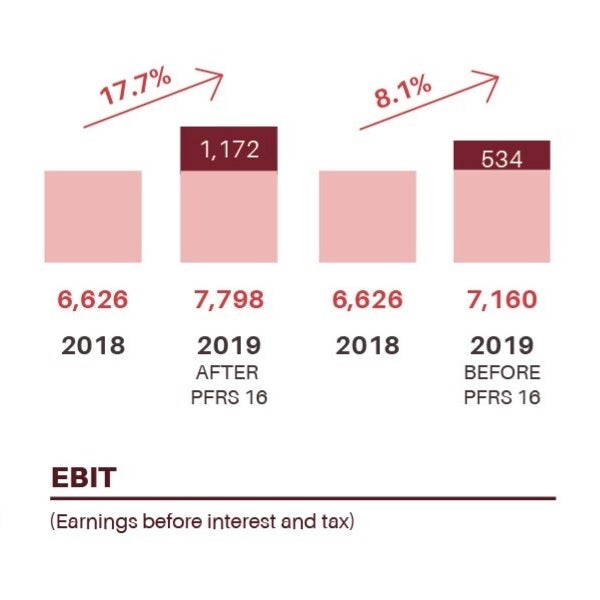

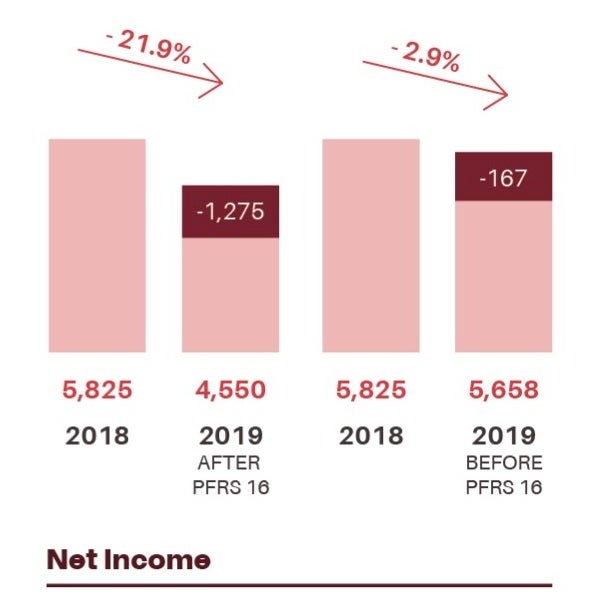

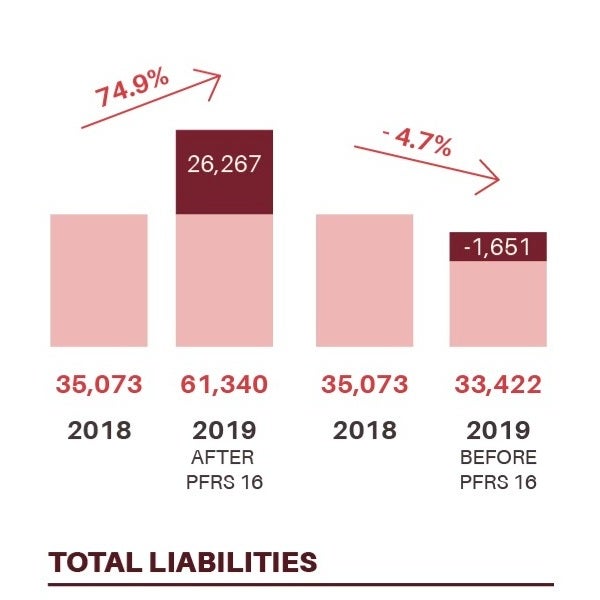

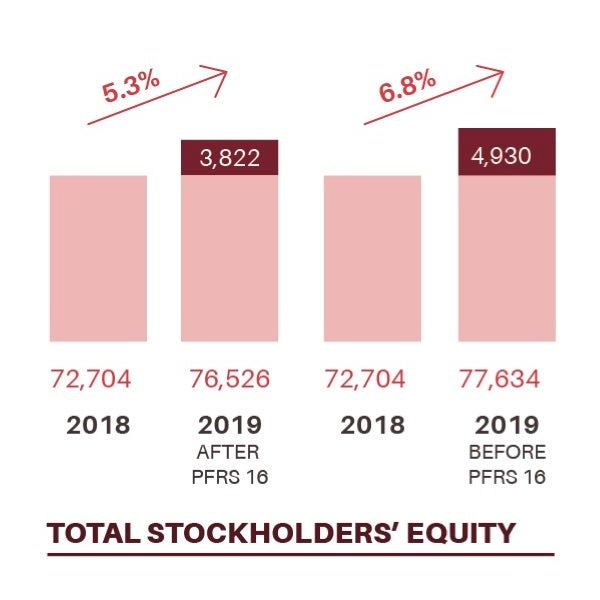

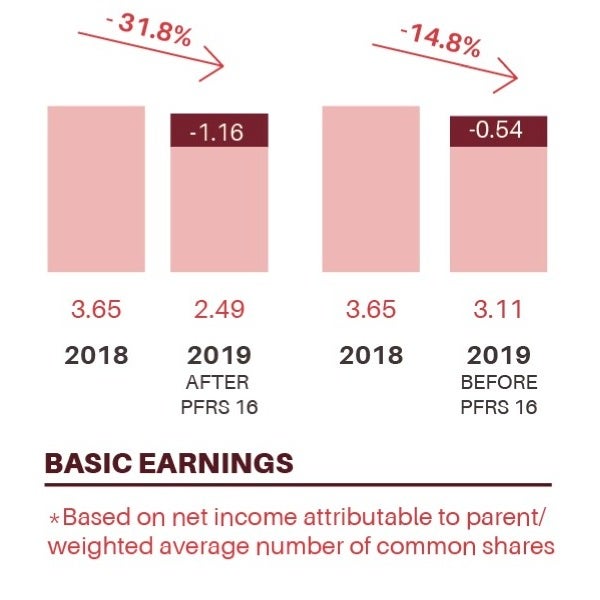

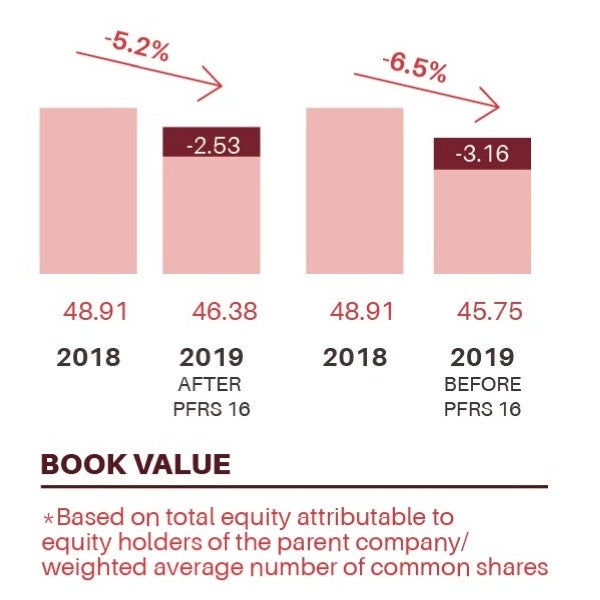

The company reflected the year-to-date impact of adopting the new Philippine Financial Reporting Standard 16 (PFRS 16) on the accounting of leases, effective January 1, 2019. The new standard stipulates that a right-of-use asset is recognized and amortized over the lease term while interest expense is incurred on the lease liability. PFRS 16 adjustments are non-cash and have no effect on the company’s cashflows.

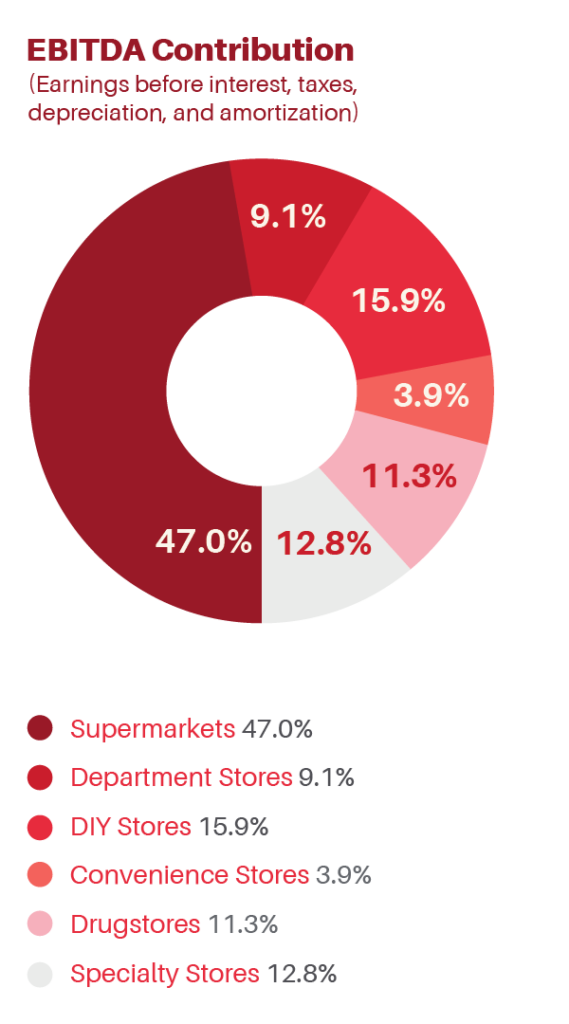

EBITDA grew by 62.7% to Php14.7 billion due to the adoption of the PFRS 16 accounting standard. Pre-PFRS 16 EBITDA grew by 13.5% to Php10.2 billion with EBITDA margin down by 50bps to 6.3% mainly due to the higher operating expenses of Rustan.

Pre-PFRS 16 EBITDA margin was on a decline year-on-year for the first three quarters in 2019, albeit with quarter-on-quarter growth. It improved by the fourth quarter with Pre-PFRS 16 EBITDA margin up by 10bps to 6.6%.

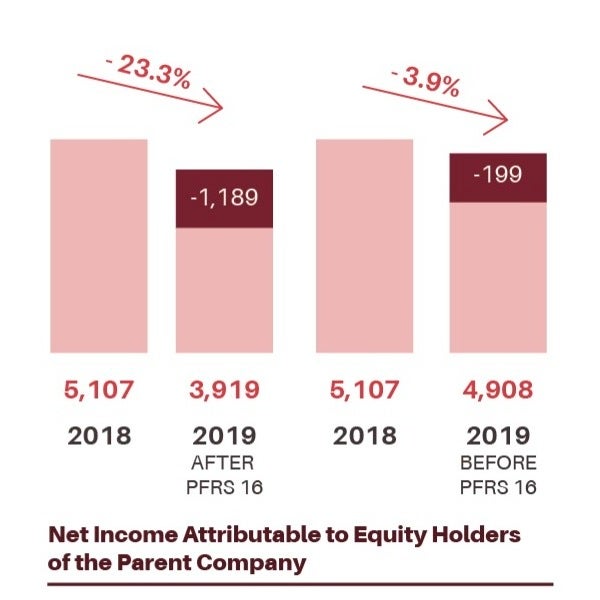

The shift to PFRS 16 reduced the core net income (net income excluding interest income on bond investments, forex gains/losses, equity in earnings of an associate and non-recurring expenses) to Php4.1 billion from Php5.0 billion the previous year. On a comparable basis using Pre-PFRS 16 figures, core income grew by 3.2% to Php5.2 billion. Net income attributable to equity holders of the parent company was down to Php3.9 billion, with the net impact of PFRS 16 amounting to Php1.0 billion in 2019.

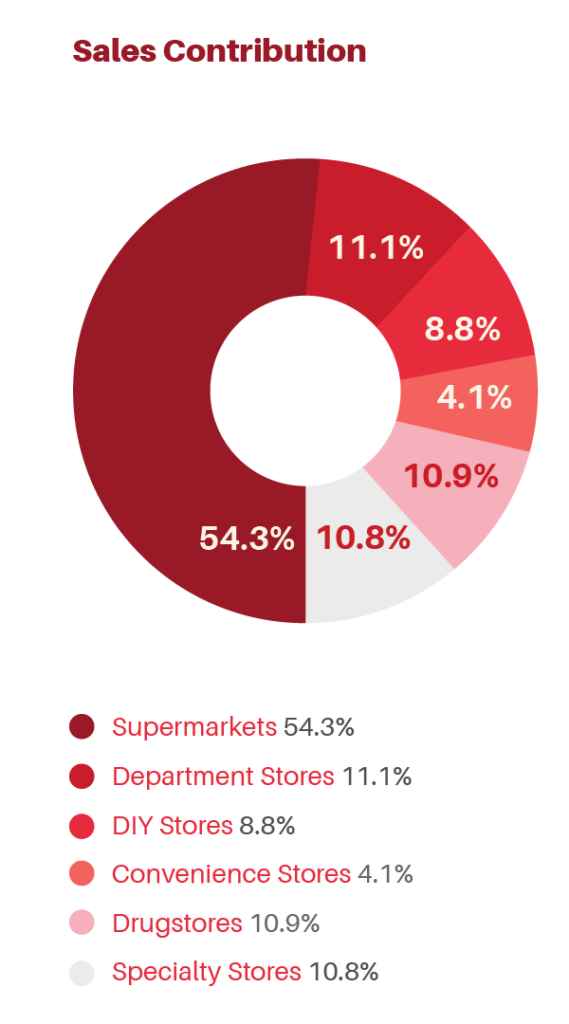

The share of the supermarket segment expanded to 54.3% of the total business from 47.0% in 2018, primarily due to the full year consolidation of Rustan, versus the previous year’s one-month consolidation of Rustan sales in December 2018.

The store network portfolio as of end 2019 totaled 1,938 stores across the country.

Excluding TGP, the gross floor area (GFA) reached 1.45 million square meters. In terms of geographic location, 764 stores are situated in Metro Manila, 843 are in Luzon, 221 in Visayas and the remainder in Mindanao. TGP ended the year with 2,001 franchised branches.

The supermarket

segment reached

Php88.5 billion in net

sales, 41.9% higher

than the previous year.

For Robinsons Retail’s recent developments in 2019, the group opened its first No Brand Store in Robinsons Galleria, which is a Korean hard discount specialty store that sells an array of private label grocery items, frozen goods, and non-food merchandise. The group has investments in e-commerce platforms such as BeautyMNL and Growsari that have shown continued gross merchandise value (GMV) growth of 1.2x and 5.7x, respectively.

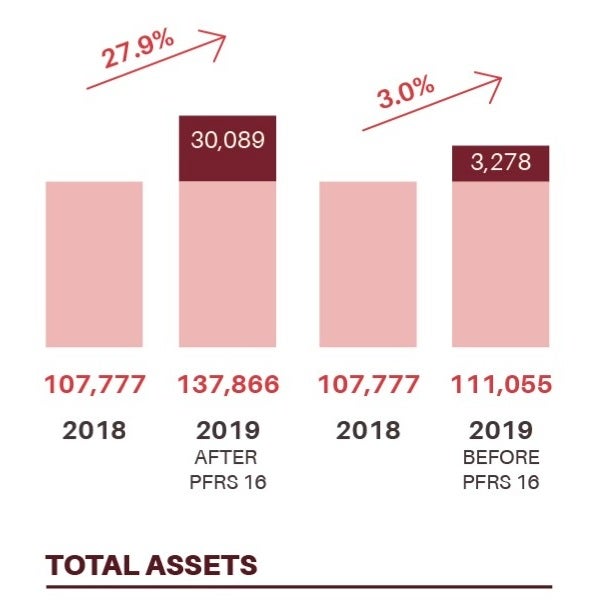

Robinsons Retail’s balance sheet was solid with cash, cash equivalents and liquid marketable securities of Php35.2 billion with borrowings of only Php4.6 billion. Current ratio was at 1.4x with consolidated assets growing by 27.9% to Php137.9 billion in 2019, post-PFRS 16.

Supermarket

The supermarket segment reached Php88.5 billion in net sales, 41.9% higher than the previous year. The sales acceleration was primarily driven by healthy SSSG, sales contribution of new stores and full year consolidation of Rustan. Excluding Rustan, the sales of Robinsons Supermarket rose by 7.5% to Php63.8 billion in 2019.

The SSSG of Robinsons Supermarket was healthy at 3.6% despite the discontinuation of online delivery service of honestbee, and the lower pork sales due to the African Swine Flu (AFS) outbreak, which led to shifts to other meat products.

The segment recorded a gross profit increase of 52.7% to Php18.6 billion, with gross margins expanding by 150bps to 21.0%, driven by the alignment of trading terms between Robinsons Supermarket and Rustan, higher listing and distribution center fees, strong vendor promo support and the resurgence in gondola rentals to support new product launches in the second half of 2019.

Post-PFRS 16 EBITDA reached Php6.9 billion from Php3.9 billion last year. Pre-PFRS 16 EBITDA increased by 27.9% to Php5.0 million, with EBITDA margin down by 60bps to 5.6% due to the higher operating expenses from Rustan. The fourth quarter saw a marked improvement in Pre-PFRS 16 EBITDA margins, up by 110bps to 6.7%, ending the three consecutive quarters decline as a result of the significant improvement in the operations of Rustan.

The supermarket segment opened 13 net stores and operated a total of 265 stores with 176 stores from Robinsons Supermarket and 89 stores, which includes two No Brand Stores, from Rustan Supercenters as of end December 2019.

Department Store

Robinsons Department Store ended 2019 with net sales amounting to Php18.0 billion, up by 1.5% year-on-year, despite closing 3 stores in Metro Manila and one in Visayas.

SSSG was a tepid 1.0%, as three of the format’s top stores underwent renovations starting in first quarter of 2019.

However, gross margin grew by 90bps to 27.7%, resulting from improvement in category mix and increase in distribution fees. Post-PFRS 16 EBITDA expanded by 44.4% to Php1.3 billion, with EBITDA margin at 7.4% of sales. Pre-PFRS 16 EBITDA margin expanded by 20bps to 5.4% as the improvement in gross margins trickled down to EBITDA.

Robinsons Department Store ended the year with 49 stores.

Do-it-Yourself

The Do-it-Yourself segment’s net sales accelerated by 3.4% to reach Php14.4 billion in 2019. SSSG softened to 2.5%, coming from a higher base of 5.0% in 2018, due to stock replenishment issues encountered with some of its major vendors. Meanwhile, gross margin improved by 50bps to 32.5% because of improved category mix and expanded scale in the Handyman business. Pre-PFRS 16 EBITDA margin was at 10.2% in 2019. On the other hand, post-PFRS 16 EBITDA margin was at 16.3%.

Under the DIY store portfolio, there were a total of 222 stores consisting of: 175 Handyman Do It Best (broad middle mall-based DIY), 28 True Value (premium mall-based DIY), 2 True Home (furnishings) and 17 Robinsons Builders (big box).

Convenience Store

Ministop’s system-wide sales and merchandise sales increased by 8.0% to Php9.8 billion and 9.2% to Php6.7 billion, respectively. The increase in sales is driven by healthy SSSG and new store openings.

SSSG was at a healthy 3.2% for 2019, as supply issues encountered in the first quarter were resolved due to better demand forecasting and logistics planning in the succeeding quarters, and with the ready-to-eat category contributing the highest proportion at 34.1% of total sales.

Total gross profit and royalty income margin declined to 35.1%, due to lower other income and one-time inventory write-offs brought about by the completion of the migration into new financial (SAP) and warehousing (JDA) systems.

Pre-PFRS 16 EBITDA margin was at 3.9% while post-PFRS 16 EBITDA margin was at 8.6%. Breaching the 500 mark, Ministop operated a total of 507 branches in 2019.

Drugstore

Consolidated net sales of the drugstore segment rose by 11.8% to Php17.7 billion in 2019, driven by strong SSSG of Southstar Drug and the sales contribution from new stores. SSSG was robust at 9.9%, with the stores responding to increased demands for medicine amidst the rise of epidemics starting in the first quarter. The growth was also driven by the improvement in Southstar Drug’s stock availability due to adjustments made in the JDA auto-replenishment program.

Blended gross margin compressed by 10bps to 19.3% due to the higher proportion of discounted sales from senior citizens and Persons With Disabilities. EBITDA margin pre-PFRS 16 improved by 10bps to 7.6%, while post-PFRS 16 EBITDA was at 9.4%.

Southstar Drug operated a total of 519 stores while TGP ended 2019 with 2,001 franchised stores.

Specialty Store

The combined net sales of the specialty store segment rose by 6.0% to Php19.3 billion. Consolidated SSSG for Specialty Stores was flattish at 1.4% in 2019, primarily slowed down by replenishment issues in Daiso Japan due to transfer of new distribution center in Malaysia coupled with JDA migration in the Philippine operations, absence of hit children’s movies in Toys ‘R’ Us, and the shift from the low margin sub-dealership in the appliances business.

The consumer appliances and electronics format contributed the most to specialty segment’s sales with 57.5% share. Specialty store gross margin was at 25.8%, with EBITDA margin pre-PFRS 16 at 6.5%. Meanwhile, post-PFRS 16 EBITDA was at 10.0%.

The specialty stores segment operated a total of 376 stores in 2019 consisting of: consumer electronics and appliances (Robinsons Appliances and Savers Appliances), toys (Toys ‘R’ Us), mass merchandise (Daiso Japan and Super50), international fashion specialty brands (Topshop, Topman, Dorothy Perkins, Miss Selfridge, Burton Menswear and Warehouse), beauty (Shiseido, Benefit, Elizabeth Arden and Club Clio), and pet retail (Pet Lovers Centre).

Overall, Robinsons Retail continued its sales and earnings momentum in 2019 through our disciplined store expansion, efficient store and supply chain operations and presence in e-commerce.

The combined net sales

of the specialty store

segment rose by 6.0%

to Php19.3 billion.

For the coming year, our goal is to foster strong business operations and strategic integrations for the business to succeed and remain resilient to disruptors. With the emergence of COVID-19 and its implications across various sectors, we will push further to safeguard the interests of our stakeholders, and we are committed to grow Robinsons Retail to new highs and continue to delight our customers.