Our

Sustainability Framework and Enterprise Risk Management

Our Sustainability Framework

As one of the largest multi-format retailers in the country, we recognize our key role in promoting sustainable development. This especially rings true for our impacts on supplier practices, employee welfare, and consumer health and well-being.

Being at the forefront, it’s our proud responsibility to consciously strive for a future that benefits all.

Enablers

Business Integrity

• Direct economic value distribution to government

• Compliance to regulations

• Risk management

Resource Management

• Materials used

• Energy consumption

• Emissions

• Water consumption

• Effluents and

waste generation

Resource Management

• Direct economic value distribution to communities

• Community Engagement

Value Creation for Stakeholders

Product diversity

for customers

• Access to key

consumer goods

• Savings on key

consumer goods

Economic opportunities for

suppliers and entrepreneurs

• Direct economic value distribution to suppliers

• Job supported in the supply chain

• Local sourcing

• Impact to local business growth

Employment opportunities

• Direct economic value distribution to employees

• Total jobs supported

directly in stores

• Diversity and

equal opportunity

• Career development

• Health and safety

Our Sustainability Framework and Enterprise Risk Management

Our Sustainability Framework

As one of the largest multi-format retailers in the country, we recognize our key role in promoting sustainable development. This especially rings true for our impacts on supplier practices, employee welfare, and consumer health and well-being.

Being at the forefront, it’s our proud responsibility to consciously strive for a future that benefits all.

Enablers

Business Integrity

• Direct economic value

distribution to government

• Compliance to regulations

• Risk management

Resource Management

• Materials used

• Energy consumption

• Emissions

• Water consumption

• Effluents and

waste generation

Resource Management

• Direct economic value

distribution to communities

• Community Engagement

Value Creation for Stakeholders

Product diversity

for customers

• Access to key

consumer goods

• Savings on key

consumer goods

Economic opportunities for

suppliers and entrepreneurs

• Direct economic value distribution to suppliers • Job supported in the supply chain • Local sourcing • Impact to local business growth

Employment opportunities

• Direct economic value

distribution to employees

• Total jobs supported

directly in stores

• Diversity and

equal opportunity

• Career development

• Health and safety

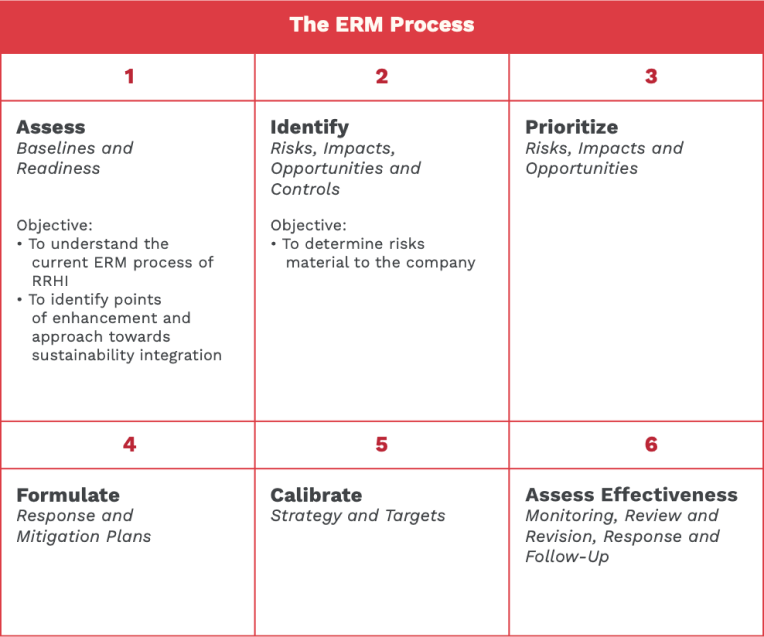

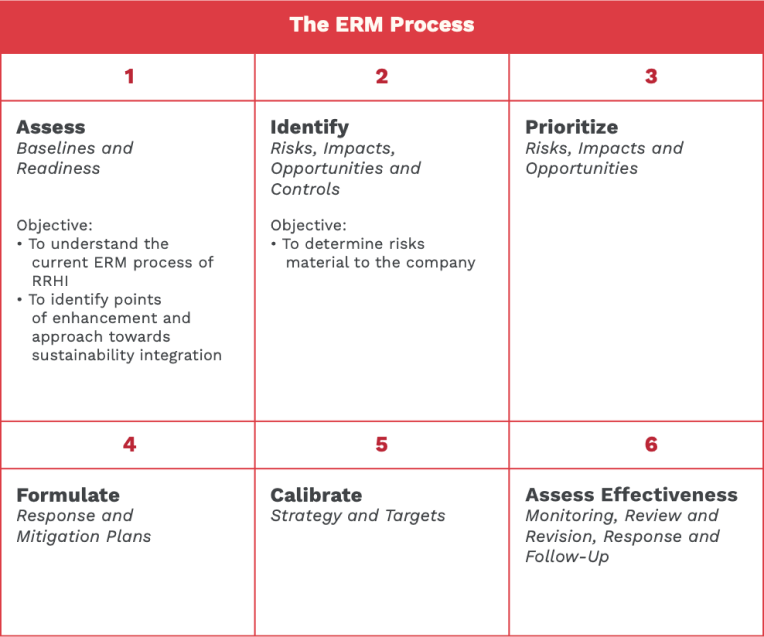

Enterprise Risk Management

in the New Normal

With the emergence of COVID-19 and deepening discussions on relevant global risks such as Climate Change and sustainable supply chains, we continue to enhance the structures for Enterprise Risk Management (ERM). With its implications on the long-term existence of the Company, Sustainability is embedded in its strategic goals, and we are in the process of linking our risks associated with our material ESG topics within our ERM universe.

In 2021, we expanded ERM training for key officers of the company. We are also currently in the process of crafting a comprehensive ERM Policy to augment our ERM Framework, taking into account material risks that were identified during the training sessions and internal assessments. The policy aims to provide an accessible structure in defining and managing risks across the Company, encouraging the adoption of a standard risk evaluation process across all aspects of our operations.

Our Approach to Mitigation

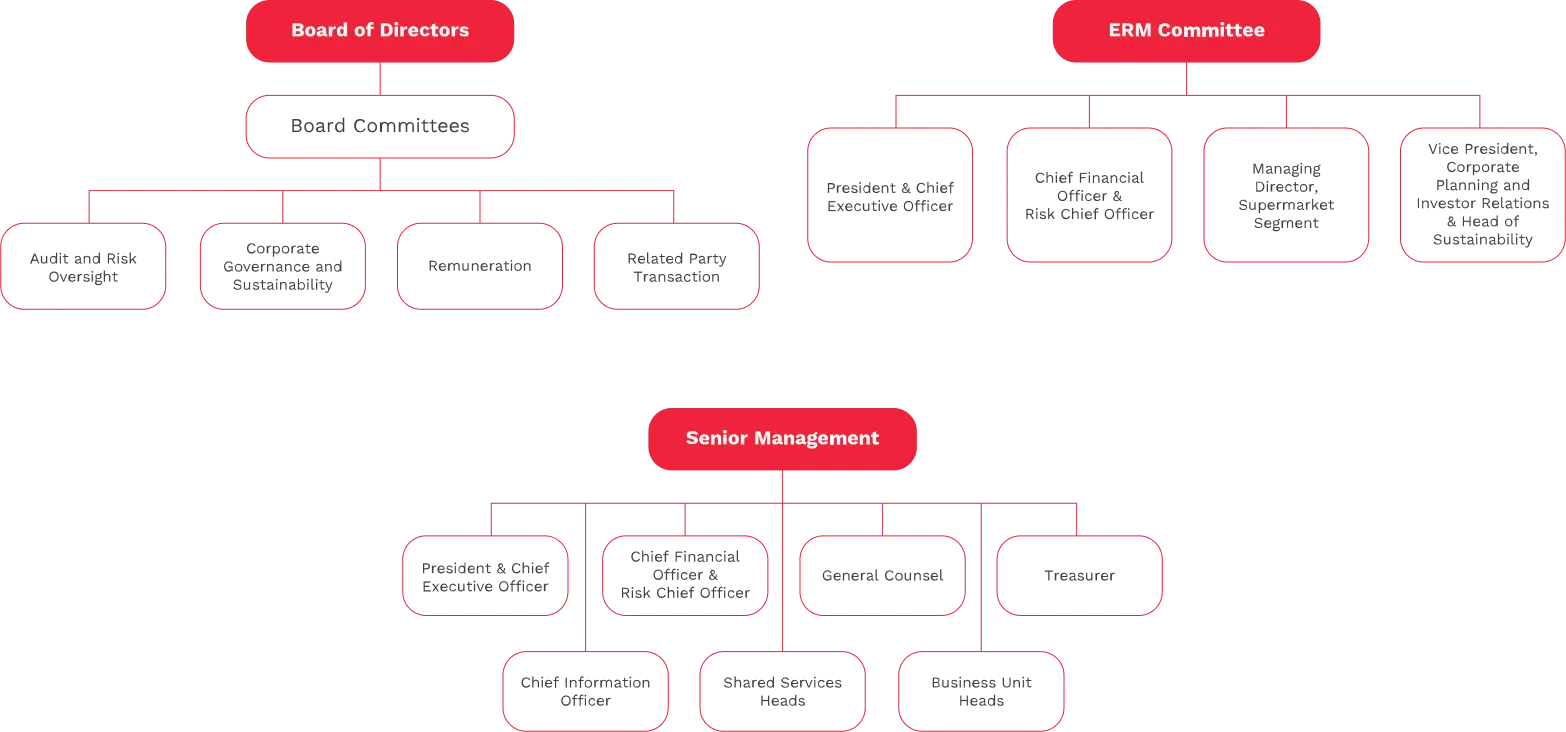

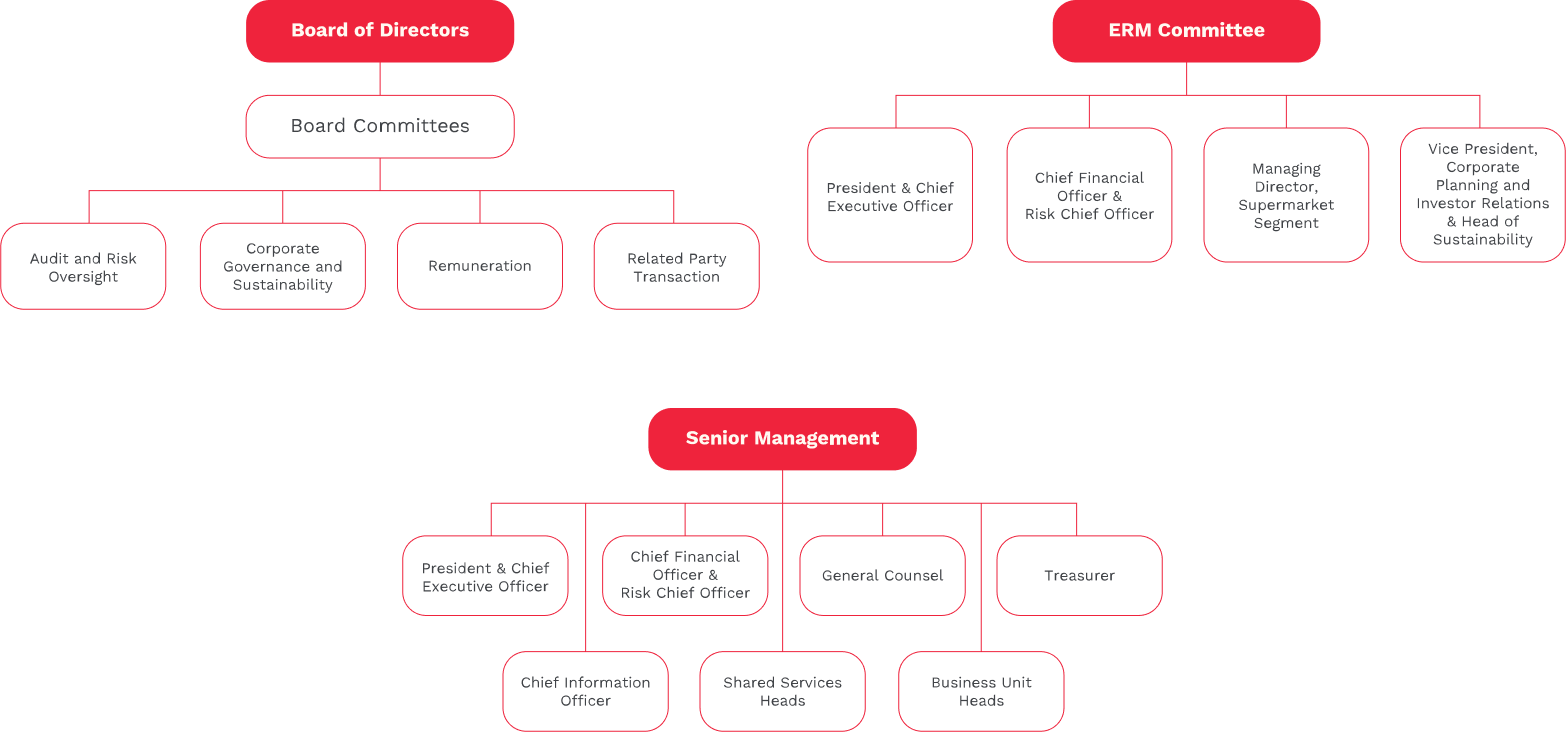

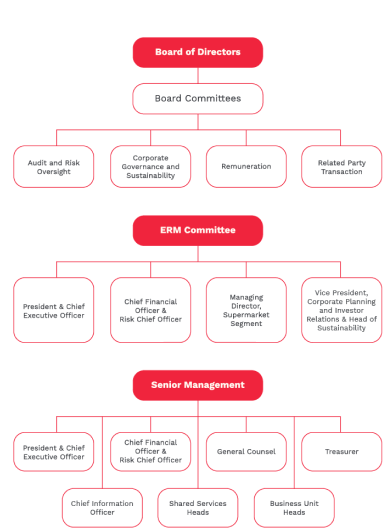

Our perspective on risk management primarily takes into account our strategic objectives, and the need to properly identify, analyze, and mitigate material risks. This responsibility is shared across the organization, namely those directly responsible for the strategic and financial activities of the Company, with oversight functions delegated to the Board of Directors, review functions to the ERM Committee, and internal controls to Senior Management.

On a more granular level, we also look at our Financial, Operational, Reputational, People, Legal and Governance and Digital Risks in our risk rating scale, which categorizes risks based on potential impacts to the business.

Prioritization is done with risks identified as “Low”, “Medium”, and “High” depending on a range of material criteria for each risk classification.

In terms of risk prioritization and analyzing severity, we take into account short, medium, and long-term timeframes, which likewise strongly inform mitigation measures. Our risk mitigation approach involves establishing systems that allow our business to be resilient to disruptions and calamity as well as nurturing a culture of agility, where constant adaptation is seen as a necessity in the dynamic environment of retail against the larger operating environment for industry.

2021 was marked as a year with significant indicators of recovery, and as such, it was necessary for us to review our main strategic drivers within the context of risk and opportunity post-COVID-19: E-commerce & Data Analytics, Organic and Inorganic Expansion, and Sustainability.

With our accelerated growth in digitalization, we identified risks to data security, customer satisfaction, and margin dilution as some of the most strategically significant in our omnichannel journey. This entailed more robust foundations in data, such as the transition to secure cloud storage partnerships and a dedicated security infrastructure to protect internal and external data.

Taking advantage of the speed in gathering feedback online, we are able to make improvements in our user interface and user experience across our e-commerce platforms to offer better service. We likewise engage our partners across our business ecosystem and negotiate effectively so all parties mutually benefit while we reduce costs and improve performance across all our banners.

While the online space may command a lot of attention in the space of innovative retail, the physical expansion of our network and inorganic growth through mergers & acquisitions remains a significant growth opportunity for Robinsons Retail. In the context of modern retail penetration, we believe there is much room to grow, and that our offline growth complements our online endeavors.

Traditional risks associated with competition and the challenges in business development are therefore still seen as significant, given that these ultimately redound to the financial sustainability of our stores. As we evolve, so do our peers and competitors, and our mitigation measures involve adapting cost-effective means for operational efficiency, making sure that we reach our targets at the store-level. In practice, we rely on our management reviews, monitoring, and strict financial controls to give us adequate visibility in enterprise risk management across all major functions of our business units.

Our perspective on risk management primarily takes into account our strategic objectives, and the need to properly identify, analyze, and mitigate material risks. This responsibility is shared across the organization, namely those directly responsible for the strategic and financial activities of the Company, with oversight functions delegated to the Board of Directors, review functions to the ERM Committee, and internal controls to Senior Management.

On a more granular level, we also look at our Financial, Operational, Reputational, People, Legal and Governance and Digital Risks in our risk rating scale, which categorizes risks based on potential impacts to the business. Prioritization is done with risks identified as “Low”, “Medium”, and “High” depending on a range of material criteria for each risk classification.

In terms of risk prioritization and analyzing severity, we take into account short, medium, and long-term timeframes, which likewise strongly inform mitigation measures. Our risk mitigation approach involves establishing systems that allow our business to be resilient to disruptions and calamity as well as nurturing a culture of agility, where constant adaptation is seen as a necessity in the dynamic environment of retail against the larger operating environment for industry.

2021 was marked as a year with significant indicators of recovery, and as such, it was necessary for us to review our main strategic drivers within the context of risk and opportunity post-COVID-19: E-commerce & Data Analytics, Organic and Inorganic Expansion, and Sustainability.

With our accelerated growth in digitalization, we identified risks to data security, customer satisfaction, and margin dilution as some of the most strategically significant in our omnichannel journey. This entailed more robust foundations in data, such as the transition to secure cloud storage partnerships and a dedicated security infrastructure to protect internal and external data.

Taking advantage of the speed in gathering feedback online, we are able to make improvements in our user interface and user experience across our e-commerce platforms to offer better service. We likewise engage our partners across our business ecosystem and negotiate effectively so all parties mutually benefit while we reduce costs and improve performance across all our banners.

While the online space may command a lot of attention in the space of innovative retail, the physical expansion of our network and inorganic growth through mergers & acquisitions remains a significant growth opportunity for Robinsons Retail. In the context of modern retail penetration, we believe there is much room to grow, and that our offline growth complements our online endeavors.

Traditional risks associated with competition and the challenges in business development are therefore still seen as significant, given that these ultimately redound to the financial sustainability of our stores. As we evolve, so do our peers and competitors, and our mitigation measures involve adapting cost-effective means for operational efficiency, making sure that we reach our targets at the store-level. In practice, we rely on our management reviews, monitoring, and strict financial controls to give us adequate visibility in enterprise risk management across all major functions of our business units.

Our ERM Structure

Our ERM Structure

Responsibilities

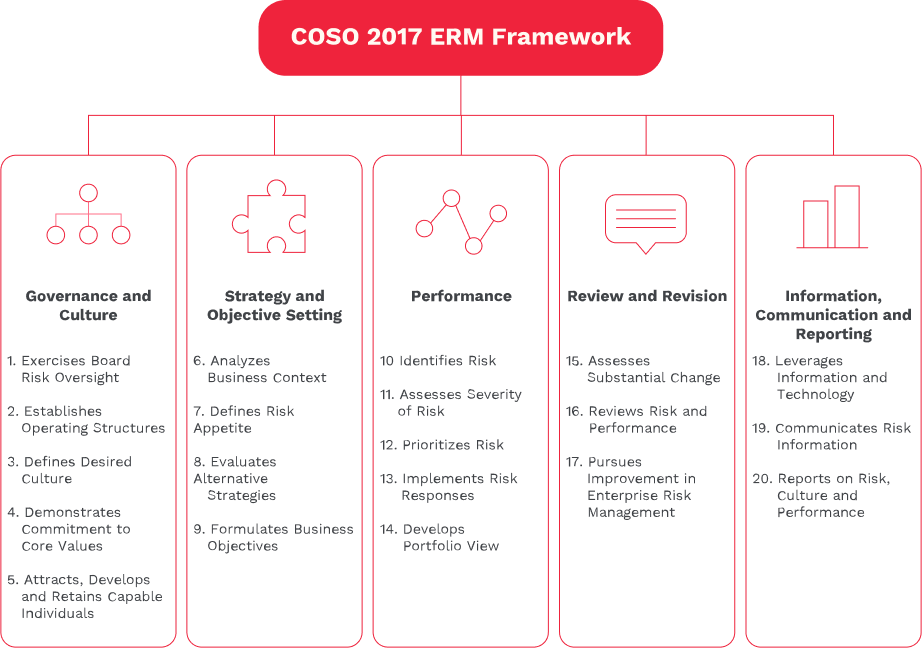

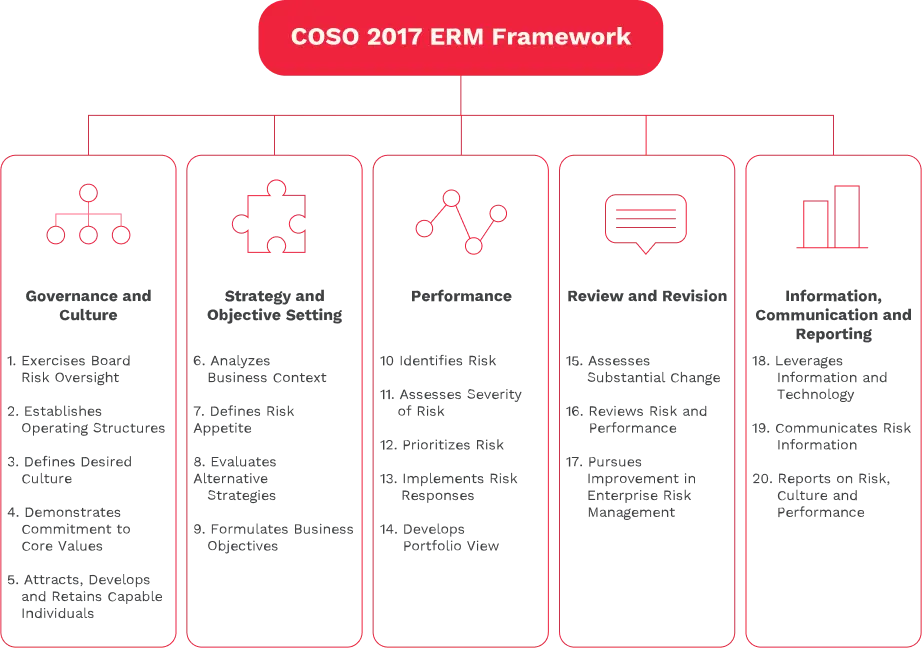

Our ERM Framework

Robinsons Retail uses the Committee of Sponsoring Organizations (COSO) 2017 Framework in its risk management, which has the following key areas: Governance and Oversight, Strategy and Objective-Setting, Performance, Review and Revision, and Information, Communication & Reporting.

Source: www.coso.org

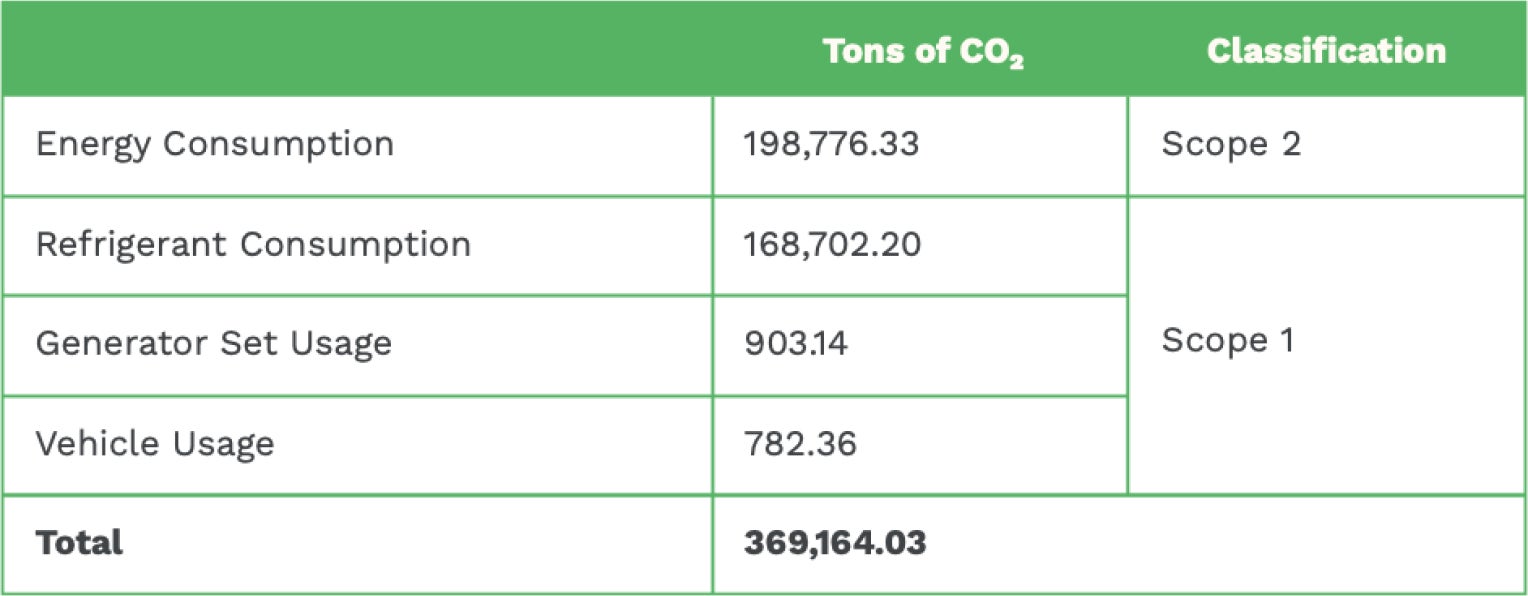

*Scope 1 emissions are derived from fuel use of Company-owned vehicles, generator sets and refrigerant usage of supermarkets. Scope 2 emissions are derived from electricity consumption of the Head Office and Business Units, excluding convenience stores and franchised stores of TGP.

A quarterly review and reporting of identified issues and equivalent resolution is conducted by the Company’s Internal Audit and Financial Systems and Controls. This guarantees that all concerns are addressed, monitored, and communicated to all concerned parties in a timely manner.

Robinsons Retail uses the Committee of Sponsoring Organizations (COSO) 2017 Framework in its risk management, which has the following key areas: Governance and Oversight, Strategy and Objective-Setting, Performance, Review and Revision, and Information, Communication & Reporting.

A quarterly review and reporting of identified issues and equivalent resolution is conducted by the Company’s Internal Audit and Financial Systems and Controls. This guarantees that all concerns are addressed, monitored, and communicated to all concerned parties in a timely manner.

A quarterly review and reporting of identified issues and equivalent resolution is conducted by the Company’s Internal Audit and Financial Systems and Controls. This guarantees that all concerns are addressed, monitored, and communicated to all concerned parties in a timely manner.

Source: www.coso.org

*Scope 1 emissions are derived from fuel use of Company-owned vehicles, generator sets and refrigerant usage of supermarkets. Scope 2 emissions are derived from electricity consumption of the Head Office and Business Units, excluding convenience stores and franchised stores of TGP.

Risk Classifications

The Risk Rating Scale was established to serve as the basis in measuring the potential impacts of risks, thereby informing different levels of Management on what risks should be prioritized in its risk universe. Divided between Low, Medium, and High, the scale is based on our considerations for materiality and severity across different Risk Classifications.

Risk Classifications

The Risk Rating Scale was established to serve as the basis in measuring the potential impacts of risks, thereby informing different levels of Management on what risks should be prioritized in its risk universe. Divided between Low, Medium, and High, the scale is based on our considerations for materiality and severity across different Risk Classifications.

Risk Classifications

Risks that potentially impact the Company’s short, medium, and long-term goals; business models and adaptive pivots in response to emerging trends in the retail industry.

Financial

Risks that are associated with RRHI’s performance across its key financial metrics, with emphasis on the net income.

Operational

Risks that are present in the daily conduct of business, such as physical risks to stores and distribution centers, as well as disruptions in the supply chain.

Reputational

Risks that affect stakeholder perspective on the principal company and its subsidiaries.

People

Risks associated with labor management and employee satisfaction.

Legal and Governance

Risks associated with compliance to pertinent laws and regulations, policy requirements, and relations with government.

Digital

Risks within the Company’s thrusts of incorporating relevant technologies in various aspects of business operations.

Strategic Risks in Climate Change and

Opportunities in Sustainability

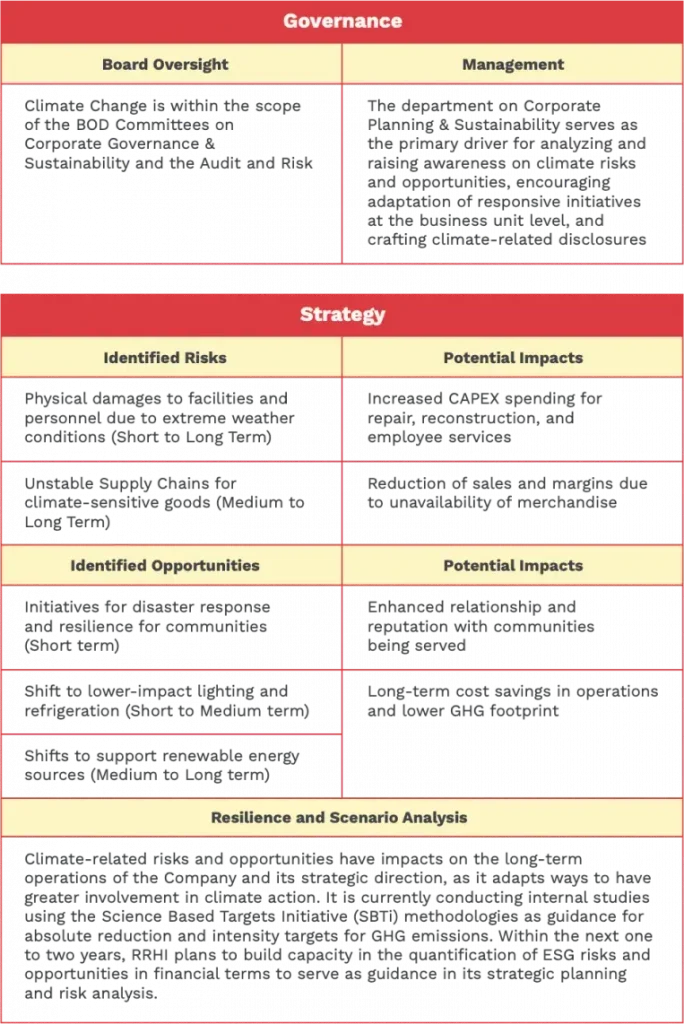

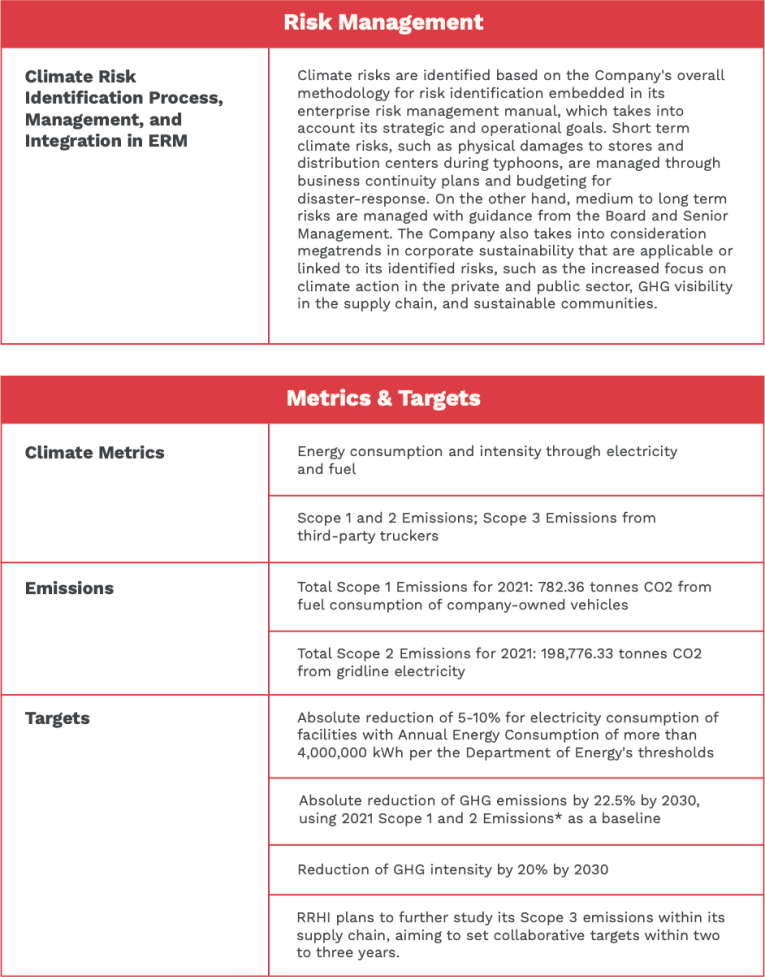

In 2021, the Company underwent capacity building for its key officers in Science-Based Targets initiative (SBTi) and Enterprise Risk Management, taking into account relevant climate issues and trends in sustainability that are material to the business. Using learnings from SBTi, we are reinforcing our data-collection efforts to serve as a baseline for target-setting, and conducting further studies internally for opportunities for absolute reduction that are aligned with the Paris Agreement.

As guidance, we use the Task Force on Climate-Related Financial Disclosures (TFCD) Framework to further improve our disclosures over time, where we take into consideration the key areas of Governance, Strategy, Risk Management, and Targets and Metrics to guide management in our approach to Climate Action. In 2021, we acknowledged that Sustainability is indeed a material aspect of governance, and RRHI’s Board Committee on Corporate Governance was changed to Corporate Governance & Sustainability. This oversees material ESG issues and how they affect the business in the long-term.

RRHI commits to a target of reducing greenhouse gas (GHG) intensity by 20% by 2030, measured as GHG emissions relative financial performance in terms of revenue. In compliance with requirements of the Department of Energy, the Company closely monitors its facilities that cross the electricity consumption threshold and seeks ways to reduce GHG emissions, with an annual target of 5-10% in absolute reduction in consumption for these facilities. Under our Supermarket Segment, we will also pursue initiatives to reduce energy intensity by 10% through more energy-efficient materials and equipment in stores, as well as the usage of lower impact refrigerants. The Supermarket Segment likewise continues its Farm to Table Program, which encourages sustainable practices in production as it sources fresh produce from small-hold farmers at fair-trade prices.

While still in the process of establishing methodologies to quantify ESG risks and opportunities in financial terms, the Company recognizes the relevance of climate-related risks and opportunities in its conduct of business. As part of its risk management exercises, our business units conducted preliminary studies on its facilities that may be affected by adverse weather conditions and what structures it has in place to mitigate both financial and physical risks to assets and personnel. At present, our business units mitigate the effects of typhoon-affected stores and buildings through insurance systems, a standard procedure to assist affected personnel and communities during disaster-response activities, and we also support initiatives that promote climate-resilience.

In terms of opportunities, as a retailer, the Company constantly seeks potential partnerships to manage environmental impact, such as those to further strengthen its knowledge-base on climate risk-mitigation, explore potential contributions for renewable energy, and waste management and diversion. It also sees potential opportunities in further promoting sustainable lifestyles through its assortment of energy-efficient products for consumers, as well as sustainably sourced merchandise with lower environmental impact.

As part of our mitigation activities, we have been continually implementing energy-saving practices over the past years in select areas of our operations, such as the shift to energy-efficient bulbs in our stores, inverter technology air-conditioners, and refrigeration systems that make use of refrigerants that have less impact on the environment.

TFCD Recommended Disclosures

Source: www.coso.org

*Scope 1 emissions are derived from fuel use of Company-owned vehicles, generators sets and refrigerant usage of supermarkets. Scope 2 emissions are derived from electricity consumption of the Head Office and Business Units, excluding convenience stores and franchised stores of TGP.

Air Emmissions

Air Emmissions

2021 Total GHG Emissions

2021 Total GHG Emissions

Resource Management

Resources Management

Energy Consumption within the organization

We rely on energy and fuel for our daily operations and across our supply chain. Energy is sourced primarily from the local electrical grid that services areas where the Company’s stores operate, and over the past three years, electricity consumption has increased over time due to our continued increase in scale of operations.

On fuel consumption, RRHI consumes gasoline for the majority of its company-owned vehicles for management and key officers, while it consumes diesel for its own fleet of delivery trucks for services not outsourced to third party truckers. Robinsons Retail also owns generator sets for back-up electricity for select stores.

We rely on energy and fuel for our daily operations and across our supply chain. Energy is sourced primarily from the local electrical grid that services areas where the

Company’s stores operate, and over the past three years, electricity consumption has increased over time due to our continued increase in scale of operations.

Company’s stores operate, and over the past three years, electricity consumption has increased over time due to our continued increase in scale of operations.

*Excludes Ministop as data collection for the format is currently ongoing

Our format that has the largest consumption of electricity is the Supermarket Segment due to the size of its stores and the need for refrigeration equipment, representing around 80% of total consumption. For comparability over the periods stated, the scope of the data for electricity consumption above excludes consumption from Ministop, RRHI’s convenience store format, which is currently undergoing a comprehensive review of consumption for more reliable data collection.

We have identified potential emissions with increased scale for stores and distribution centers that have not yet converted to energy efficient technologies, so we are developing action plans to reduce the dependence on high-intensity equipment across our operations. Our Engineering Department spearheads initiatives on the conversion to equipment which uses less energy and makes use of refrigerants with a lower carbon footprint, once old equipment reaches its end-of-life usage.

On fuel consumption, RRHI consumes gasoline for the majority of its company-owned vehicles for management and key officers, while it consumes diesel for its own fleet of delivery trucks for services not outsourced to third party truckers. Robinsons Retail also owns generator sets for back-up electricity for select stores.

*Excludes Ministop as data collection for the format is currently ongoing

Our format that has the largest consumption of electricity is the Supermarket Segment due to the size of its stores and the need for refrigeration equipment, representing around 80% of total consumption. For comparability over the periods stated, the scope of the data for electricity consumption above excludes consumption from Ministop, RRHI’s convenience store format, which is currently undergoing a comprehensive review of consumption for more reliable data collection.

We have identified potential emissions with increased scale for stores and distribution centers that have not yet converted to energy efficient technologies, so we are developing action plans to reduce the dependence on high-intensity equipment across our operations. Our Engineering Department spearheads initiatives on the conversion to equipment which uses less energy and makes use of refrigerants with a lower carbon footprint, once old equipment reaches its end-of-life usage.

*Excludes Ministop as data collection for the format is currently ongoing

Water Consumption Within the Organization

As a retailing company, our core operations are not as water intensive as other businesses, and we source water through local third-party lines. We primarily consume water through employee lavatories and the maintenance of cleanliness at work areas and stores. Water consumption is monitored and daily maintenance and monitoring of office pipes is conducted to address leakage. We are also exploring the possible implementation of water-saving facilities across our stores, distribution centers, and headquarters.

water through employee lavatories and the maintenance of cleanliness at work areas and stores. Water consumption is monitored and daily maintenance and monitoring of office pipes is conducted to address leakage. We are also exploring the possible implementation of water-saving facilities across our stores, distribution centers, and headquarters.

*2019 data exclude consumption from Shopwise and The Marketplace

Water Consumption Within the Organization

*2019 data exclude consumption from Shopwise and The Marketplace

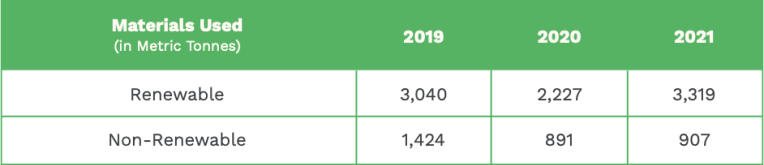

Materials Used by the Organization

Robinsons Retail’s business operations rely on paper and plastic as primary materials for packing goods at the point of sale, which consumers will then bring to their homes. The scope of this disclosure includes estimates of weighted plastics and paper (renewable) and plastic (non-renewable) bags centrally procured. Further studies are also being undertaken to estimate the materials footprint of the company across its other subsidiaries and sites of operation.

Robinsons Retail’s business operations rely on paper and plastic as primary materials for packing goods at the point of sale, which consumers will then bring to their

homes. The scope of this disclosure includes estimates of weighted plastics and paper (renewable) and plastic (non-renewable) bags centrally procured. Further studies are also being undertaken to estimate the materials footprint of the company across its other subsidiaries and sites of operation.

Materials Used by

the Organization

*2019 data exclude consumption from Shopwise and The Marketplace

We consider packaging of goods, which we procure from third party suppliers, in our material usage since it does not overlap with the manufacturing of goods as a primary business of retail. We approach material efficiency from the perspectives of both compliance and customer engagement, and mitigate potential risks through strict adherence with the pertinent regulations on using plastic and paper in stores from local governments.

We likewise inform and encourage our customers to reduce uncontrolled waste disposal through initiatives that divert waste from the natural environment into usable recycled items, such as the “Easy on Plastic” and

We consider packaging of goods, which we procure from third party suppliers, in our material usage since it does not overlap with the manufacturing of goods as a primary business of retail. We approach material efficiency from the perspectives of both compliance and customer engagement, and mitigate potential risks through strict adherence with the pertinent regulations on using plastic and paper in stores from local governments.

We likewise inform and encourage our customers to reduce uncontrolled waste disposal through initiatives that divert waste from the natural environment into usable recycled items, such as the “Easy on Plastic” and “Green Fund” projects. We also have contracts with recyclers, and are constantly in talks for alternative packaging and customer engagement opportunities, as well as crafting a comprehensive waste/material tracking system to manage our solid waste footprint.

Digitalization also plays a key-role in resource management for RRHI. Our Shared Services Departments also implemented resource reduction initiatives, with less reliance on paper across transactions and investment in printing equipment that make use of less ink and materials. The Business Unit Marketing Departments have likewise reduced dependence on printed collateral in favor of Digital Marketing.

“Green Fund” projects. We also have contracts with recyclers, and are constantly in talks for alternative packaging and customer engagement opportunities, as well as crafting a comprehensive waste/material tracking system to manage our solid waste footprint.

Digitalization also plays a key-role in resource management for RRHI. Our Shared Services Departments also implemented resource reduction initiatives, with less reliance on paper across transactions and investment in printing equipment that make use of less ink and materials. The Business Unit Marketing Departments have likewise reduced dependence on printed collateral in favor of Digital Marketing.

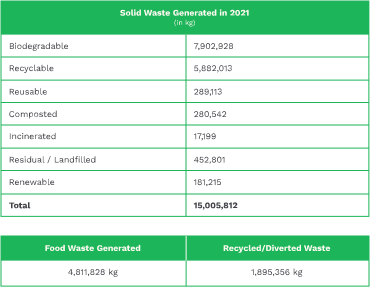

Solid Waste Management

Our operations generate solid wastes, primarily through our stores and distribution centers. With this, we have policies in place in all stores and distribution centers for waste segregation, and continue to streamline our data collection

Our operations generate solid wastes, primarily through our stores and distribution centers. With this, we have policies in place in all stores and distribution centers for waste segregation, and continue to streamline our data collection systems to cover a wider scope and provide accurate data in our disclosures. At present, we are concentrating on building monitoring

systems to cover a wider scope and provide accurate data in our disclosures. At present, we are concentrating on building monitoring systems for our supermarkets, whose solid waste management is especially material due to its diverse waste profile. In coordination with our vendors, we also strictly comply with requirements on proper disposal of identified “bad” or expired products and make sure that sub-par items do not reach the market.

Solid Waste Management

systems for our supermarkets, whose solid waste management is especially material due to its diverse waste profile. In coordination with our vendors, we also strictly comply with requirements on proper disposal of identified “bad” or expired products and make sure that sub-par items do not reach the market.

Our Economic and

Social Contributions

Our Economic and Social Contributions

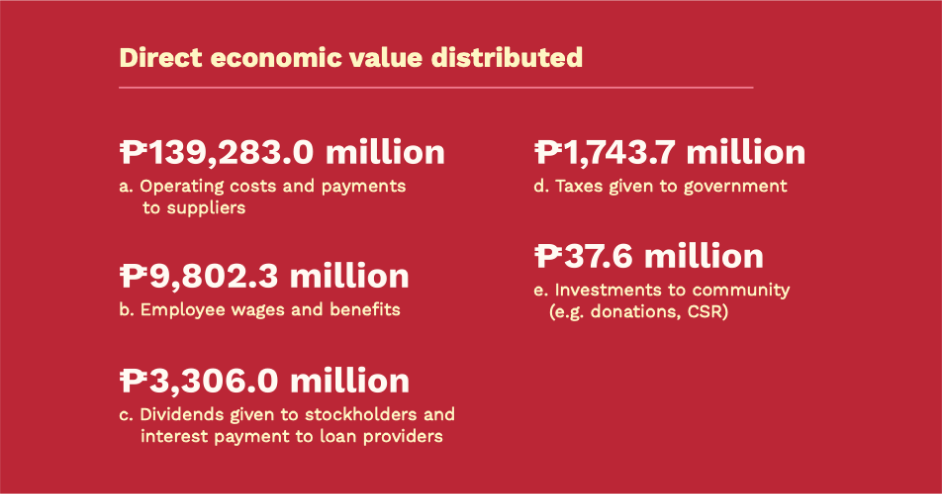

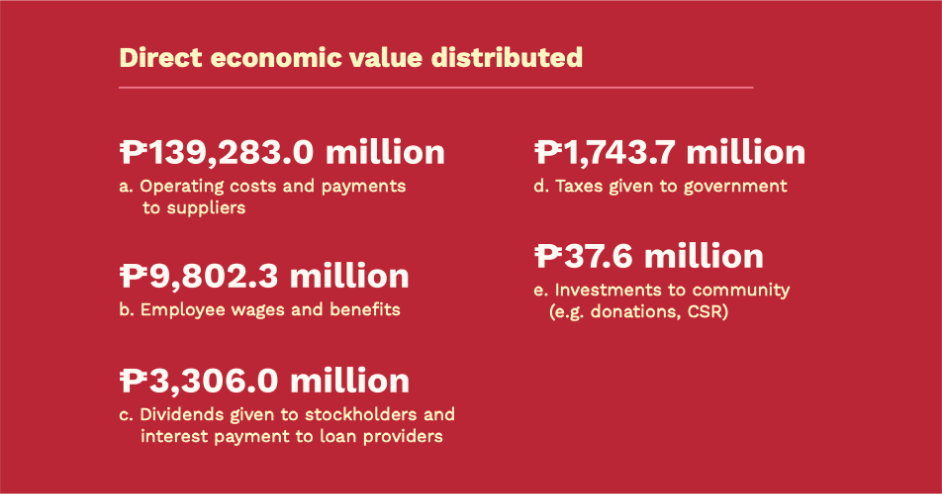

Direct Economic Value Generated and Distributed

Our Products and Partners

Our aim is to maintain our position as one the largest multi-format retailers in the Philippines catering to the broad middle-income market. We plan to expand its store network across our retail formats with focus on regions outside of Metro Manila where modern retail penetration is still low. Aside from organic expansion, part of our strategy is to participate in the market’s consolidation by entering into mergers and acquisitions in existing and complementary retail formats.

We target consistent sales growth while improving margins to ensure sustainability of operations, and have identified the following opportunities to generate and distribute greater economic value to our stakeholders

The economic value generated from Robinsons Retail’s activities primarily affect the economic conditions of the areas where we operate. Our operations and supply chain allow us to directly and indirectly support employment and foster a sophisticated system of partners and suppliers from across various entrepreneurial backgrounds — from big manufacturers, to small and medium enterprises for both the trade and non-trade needs of our business units.

As we conduct our day-to-day processes, we believe that we positively contribute to economic growth and social mobility among our stakeholders, from our employees, our customers, to our suppliers. We operate as a multi-format stakeholder with a diverse portfolio offering the market both staple and discretionary goods and services. We aim to maintain our strong financial foundations to continue operations and remain resilient, develop business continuity plans to protect our assets, and have a dedicated Enterprise Risk Management Team overseen by the Board of Directors.

Our aim is to maintain our position as one the largest multi-format retailers in the Philippines catering to the broad middle-income market. We plan to expand its store network across our retail formats with focus on regions outside of Metro Manila where modern retail penetration is still low. Aside from organic expansion, part of our strategy is to participate in the market’s consolidation by entering into mergers and acquisitions in existing and complementary retail formats.

We target consistent sales growth while improving margins to ensure sustainability of operations, and have identified the following opportunities to generate and distribute greater economic value to our stakeholders:

• Store expansion into underpenetrated cities and municipalities

• E-commerce and digital investments

• Strategic synergies with partners and affiliates

• Mergers & Acquisitions

• Better margins through increased scale

• Deepening involvement in sustainable initiatives

Throughout 2020 and 2021, we implemented our Share Buy Back Program totaling Php 4.0 billion to protect and sustain shareholder value. The Company increased the annual cash dividend payout ratio to 89.4 percent in 2021 from 40.2 percent in 2020 of its audited consolidated net income for the preceding fiscal year. With our stakeholders in mind, we craft long-term objectives and goals, which include strengthening our business development for store expansion and identification of key areas for efficiency within our business, such as looking towards data-driven decision making especially in bolstering its loyalty programs, efficiency in supply chains and operations, and collaborative initiatives with partners for sustainability.

Robinsons Retail:

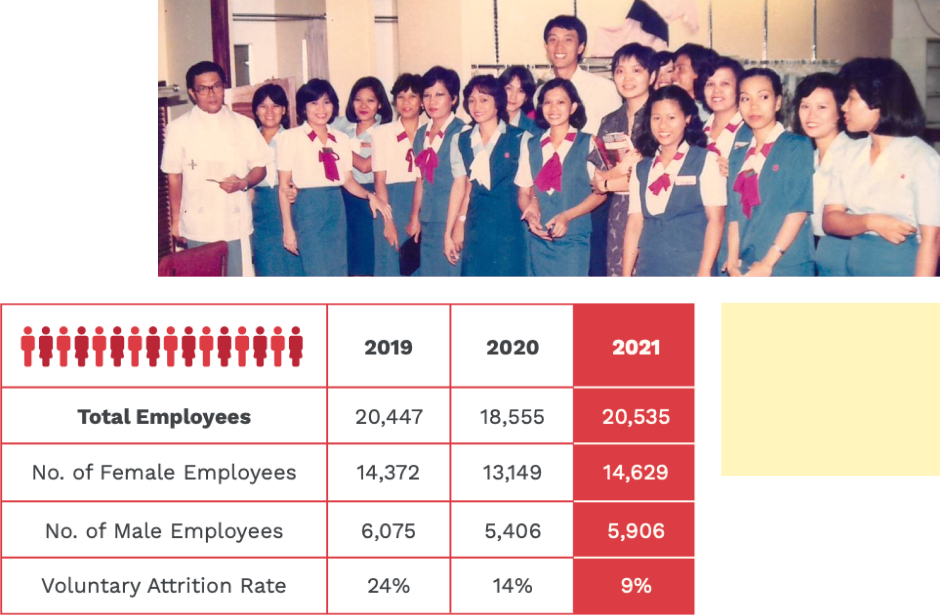

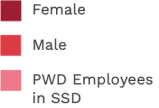

A Space for Gender Equality

The roots of gender equality in Robinsons Retail began with our very founder, Mr. John L. Gokongwei, Jr. Mr. John’s earliest venture into business was with his mother when he was a young boy, and throughout his career as an entrepreneur, he held onto the belief that women can contribute as much as men can in any business. This egalitarian sensibility persists to this day in the companies he established. At Robinsons Retail, we see this largely in the composition of its workforce, its leaders, and its value proposition across its banners.

We constantly strive to foster inclusive spaces where anyone can prosper regardless of gender. At present, Robinsons Retail’s employee base is 70% women, with female employees fulfilling leadership roles across all levels of management, including the Chief Financial Officer, Corporate Secretary, Head of Corporate Planning, Investor Relations and Sustainability; and six out of 11 of our Business Unit Heads.

In 2021, we were recognized by the Corporate Women Directors International (CWDI) as one of the top corporations led by women across the globe. CWDI is a nonprofit organization based in Washington, which surveyed nearly 3,000 companies in 55 countries to generate baseline data on women in leadership roles.

Our aim is to maintain our position as one the largest multi-format retailers in the Philippines catering to the broad middle-income market. We plan to expand its store network across our retail formats with focus on regions outside of Metro Manila where modern retail penetration is still low. Aside from organic expansion, part of our strategy is to participate in the market’s consolidation by entering into mergers and acquisitions in existing and complementary retail formats.

We target consistent sales growth while improving margins to ensure sustainability of operations, and have identified the following opportunities to generate and distribute greater economic value to our stakeholders:

• Store expansion into underpenetrated cities and municipalities

• E-commerce and digital investments

• Strategic synergies with partners and affiliates

• Mergers & Acquisitions

• Better margins through increased scale

• Deepening involvement in sustainable initiatives

The economic value generated from Robinsons Retail’s activities primarily affect the economic conditions of the areas where we operate. Our operations and supply chain allow us to directly and indirectly support employment and foster a sophisticated system of partners and suppliers from across various entrepreneurial backgrounds — from big manufacturers, to small and medium enterprises for both the trade and non-trade needs of our business units.

As we conduct our day-to-day processes, we believe that we positively contribute to economic growth and social mobility among our stakeholders, from our employees, our customers, to our suppliers. We operate as a multi-format stakeholder with a diverse portfolio offering the market both staple and discretionary goods and services. We aim to maintain our strong financial foundations to continue operations and remain resilient, develop business continuity plans to protect our assets, and have a dedicated Enterprise Risk Management Team overseen by the Board of Directors.

Throughout 2020 and 2021, we implemented our Share Buy Back Program totaling Php 4.0 billion to protect and sustain shareholder value. The Company increased the annual cash dividend payout ratio to 89.4 percent in 2021 from 40.2 percent in 2020 of its audited consolidated net income for the preceding fiscal year. With our stakeholders in mind, we craft long-term objectives and goals, which include strengthening our business development for store expansion and identification of key areas for efficiency within our business, such as looking towards data-driven decision making especially in bolstering its loyalty programs, efficiency in supply chains and operations, and collaborative initiatives with partners for sustainability.

The economic value generated from Robinsons Retail’s activities primarily affect the economic conditions of the areas where we operate. Our operations and supply chain allow us to directly and indirectly support employment and foster a sophisticated system of partners and suppliers from across various entrepreneurial backgrounds — from big manufacturers, to small and medium enterprises for both the trade and non-trade needs of our business units.

As we conduct our day-to-day processes, we believe that we positively contribute to economic growth and social mobility among our stakeholders, from our employees, our customers, to our suppliers. We operate as a multi-format stakeholder with a diverse portfolio offering the market both staple and discretionary goods and services. We aim to maintain our strong financial foundations to continue operations and remain resilient, develop business continuity plans to protect our assets, and have a dedicated Enterprise Risk Management Team overseen by the Board of Directors.

Throughout 2020 and 2021, we implemented our Share Buy Back Program totaling Php 4.0 billion to protect and sustain shareholder value. The Company increased the annual cash dividend payout ratio to 89.4 percent in 2021 from 40.2 percent in 2020 of its audited consolidated net income for the preceding fiscal year. With our stakeholders in mind, we craft long-term objectives and goals, which include strengthening our business development for store expansion and identification of key areas for efficiency within our business, such as looking towards data-driven decision making especially in bolstering its loyalty programs, efficiency in supply chains and operations, and collaborative initiatives with partners for sustainability.

The economic value generated from Robinsons Retail’s activities primarily affect the economic conditions of the areas where we operate. Our operations and supply chain allow us to directly and indirectly support employment and foster a sophisticated system of partners and suppliers from across various entrepreneurial backgrounds — from big manufacturers, to small and medium enterprises for both the trade and non-trade needs of our business units.

As we conduct our day-to-day processes, we believe that we positively contribute to economic growth and social mobility among our stakeholders, from our employees, our customers, to our suppliers. We operate as a multi-format stakeholder with a diverse portfolio offering the market both staple and discretionary goods and services. We aim to maintain our strong financial foundations to continue operations and remain resilient, develop business continuity plans to protect our assets, and have a dedicated Enterprise Risk Management Team overseen by the Board of Directors.

Throughout 2020 and 2021, we implemented our Share Buy Back Program totaling Php 4.0 billion to protect and sustain shareholder value. The Company increased the annual cash dividend payout ratio to 89.4 percent in 2021 from 40.2 percent in 2020 of its audited consolidated net income for the preceding fiscal year. With our stakeholders in mind, we craft long-term objectives and goals, which include strengthening our business development for store expansion and identification of key areas for efficiency within our business, such as looking towards data-driven decision making especially in bolstering its loyalty programs, efficiency in supply chains and operations, and collaborative initiatives with partners for sustainability.

Our aim is to maintain our position as one the largest multi-format retailers in the Philippines catering to the broad middle-income market. We plan to expand its store network across our retail formats with focus on regions outside of Metro Manila where modern retail penetration is still low. Aside from organic expansion, part of our strategy is to participate in the market’s consolidation by entering into mergers and acquisitions in existing and complementary retail formats.

We target consistent sales growth while improving margins to ensure sustainability of operations, and have identified the following opportunities to generate and distribute greater economic value to our stakeholders:

• Store expansion into underpenetrated cities and municipalities

• E-commerce and digital investments

• Strategic synergies with partners and affiliates

• Mergers & Acquisitions

• Better margins through increased scale

• Deepening involvement in sustainable initiatives

Throughout 2020 and 2021, we implemented our Share Buy Back Program totaling Php 4.0 billion to protect and sustain shareholder value. The Company increased the annual cash dividend payout ratio to 89.4 percent in 2021 from 40.2 percent in 2020 of its audited consolidated net income for the preceding fiscal year. With our stakeholders in mind, we craft long-term objectives and goals, which include strengthening our business development for store expansion and identification of key areas for efficiency within our business, such as looking towards data-driven decision making especially in bolstering its loyalty programs, efficiency in supply chains and operations, and collaborative initiatives with partners for sustainability.

Robinsons Retail:

A Space for Gender Equality

The roots of gender equality in Robinsons Retail began with our very founder, Mr. John L. Gokongwei, Jr. Mr. John’s earliest venture into business was with his mother when he was a young boy, and throughout his career as an entrepreneur, he held onto the belief that women can contribute as much as men can in any business. This egalitarian sensibility persists to this day in the companies he established. At Robinsons Retail, we see this largely in the composition of its workforce, its leaders, and its value proposition across its banners.

We constantly strive to foster inclusive spaces where anyone can prosper regardless of gender. At present, Robinsons Retail’s employee base is 70% women, with female employees fulfilling leadership roles across all levels of management, including the Chief Financial Officer, Corporate Secretary, Head of Corporate Planning, Investor Relations and Sustainability; and six out of 11 of our Business Unit Heads.

In 2021, we were recognized by the Corporate Women Directors International (CWDI) as one of the top corporations led by women across the globe. CWDI is a nonprofit organization based in Washington, which surveyed nearly 3,000 companies in 55 countries to generate baseline data on women in

leadership roles.

Direct Economic Value Generated and Distributed

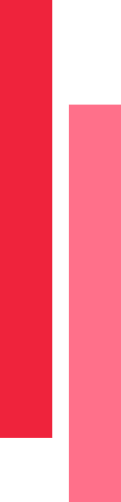

Inclusion in the Bloomberg

Gender Equality Index

Inclusion in the Bloomberg Gender Equality Index

Robinsons Retail Holdings, Inc. marked its inclusion in the Bloomberg LP Gender Equality Index (GEI) 2022 on January 26, 2022. The GEI is a modified market capitalization-weighted index that aims to track the performance of public companies committed to transparency in gender-data reporting.

This year, 418 companies across 11 sectors and 45 countries were included in the list, with Robinsons Retail being one of only four Filipino companies in the 2022 GEI. These companies meet the criteria set by GEI and have a score above a global threshold established by the firm to reflect a high level of disclosure and overall performance across five dimensions: female leadership & talent pipeline; equal pay and gender pay parity; inclusive culture; anti-sexual harassment policies; and pro-women brand.

At present, Robinsons Retail’s female employees fulfill leadership roles across all levels of management, including CFO Mylene Kasiban, Corporate Secretary Lynn Rivera, and Head of Investor Relations Gina Dipaling.

Robinsons Retail Holdings, Inc. marked its inclusion in the Bloomberg LP Gender Equality Index (GEI) 2022 on January 26, 2022. The GEI is a modified market capitalization-weighted index that aims to track the performance of public companies committed to transparency in gender-data reporting.

This year, 418 companies across 11 sectors and 45 countries were included in the list, with Robinsons Retail being one of only four Filipino companies in the 2022 GEI. These companies meet the criteria set by GEI and have a score above a global threshold established by the firm to reflect a high level of disclosure and overall performance across five dimensions: female leadership & talent pipeline; equal pay and gender pay parity; inclusive culture; anti-sexual harassment policies; and pro-women brand.

At present, Robinsons Retail’s female employees fulfill leadership roles across all levels of management, including CFO Mylene Kasiban, Corporate Secretary Lynn Rivera, and Head of Investor Relations Gina Dipaling.

Further bolstering our capabilities in managing ESG (environment, social, and governance) impacts, we deepened our understanding of Enterprise Risk Management (ERM) through the lens of sustainability. We are forming the foundations to enhance our disclosures in sustainability while taking into account key material trends, emphasizing risks and opportunities that are material to Robinsons Retail and its business units. Lastly, we established the Corporate Governance and Sustainability Committee, signifying to our stakeholders that sustainability is a relevant aspect in the long-term views of Robinsons Retail at the level of the Board.

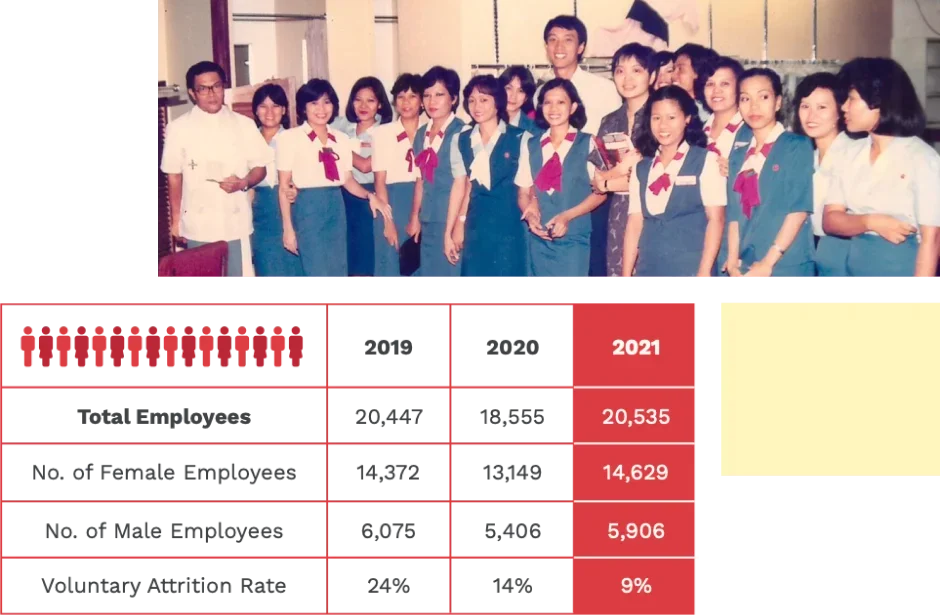

Diversity and Equal Opportunity

* Vulnerable sectors include: elderly, persons with disabilities, vulnerable women, refugees, migrants, internally displaced persons, people living with HIV and other diseases, solo parents, and the poor or the base of the pyramid (BOP; Class D and E).

¹ PWD employees from Southstar Drug’s Project Inclusion Partnership with Unilab Foundation

* Vulnerable sectors include: elderly, persons with disabilities, vulnerable women, refugees, migrants, internally displaced persons, people living with HIV and other diseases, solo parents, and the poor or the base of the pyramid (BOP; Class D and E).

¹ PWD employees from Southstar Drug’s Project Inclusion Partnership with Unilab Foundation

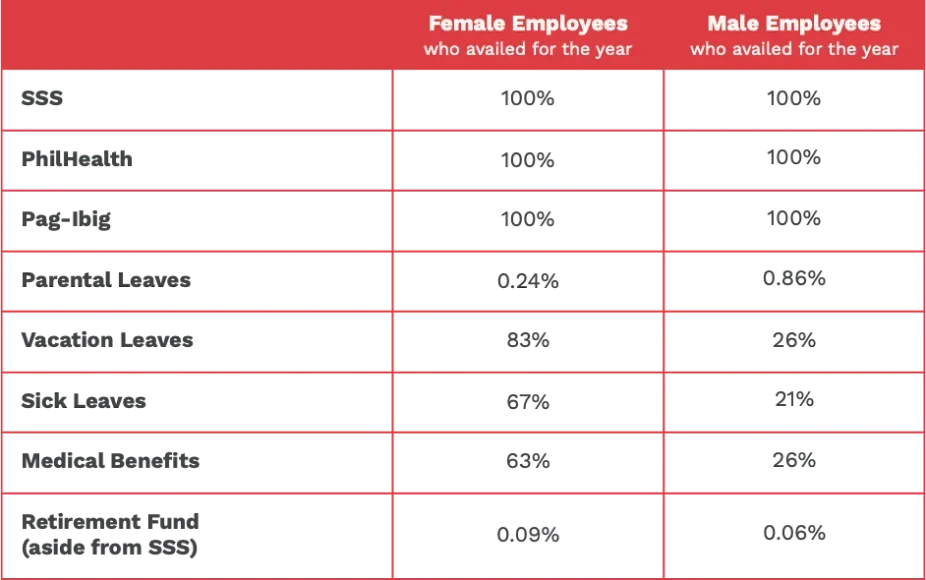

Our hiring process, career advancement, and organizational culture takes an objective, non-gendered approach to determining compensation rates of its employees, from the hiring process to the onboarding of the employee. Compensation rates and promotions are also merit and qualification-based, and benchmarked with industry rates. We also provide benefits beyond what is mandated by the government, including transport services, assistance and allowance

packages, loans, and various other incentives.

Benefits and compensation are key factors in determining employee satisfaction and talent retention for the Company to maintain its operations. We acknowledge that attrition and employee poaching are risks we constantly face, and we believe that adequate compensation and above-average benefits are effective strategies for talent acquisition and retention.

Our hiring process, career advancement, and organizational culture takes an objective, non-gendered approach to determining compensation rates of its employees, from the hiring process to the onboarding of the employee. Compensation rates and promotions are also merit and qualification-based, and benchmarked with industry rates. We also provide benefits beyond what is mandated by the government, including transport services, assistance and allowance packages, loans, and various other incentives.

Benefits and compensation are key factors in determining employee satisfaction and talent retention for the Company to maintain its operations. We acknowledge that attrition and employee poaching are risks we constantly face, and we believe that adequate compensation and above-average benefits are effective strategies for talent acquisition and retention.

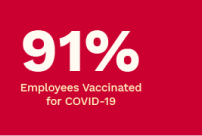

Taking Care of Our People

As of end 2021, we are proud to share that 91% of our employees and third-party personnel were inoculated with vaccines for COVID-19, with vaccination drives continuing into 2022. In partnership with local government units through the Gokongwei Group Vaccination Program, COVID Protect, shots of AstraZeneca, Moderna, and Sinovac were administered to our employees and their chosen dependents. We believe that through these efforts and in support of government-led booster shot drives, we are on the road to moving forward beyond COVID-19.

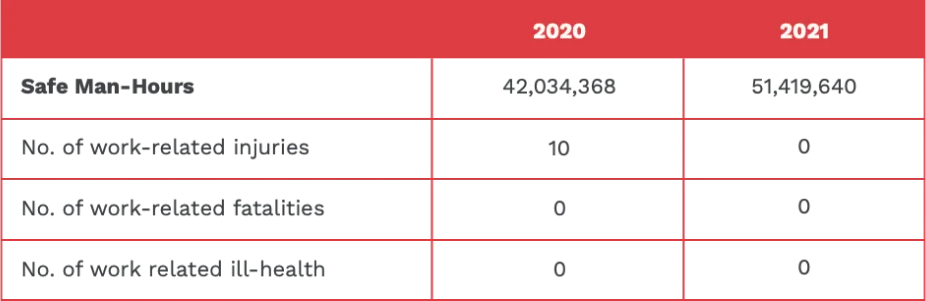

As part of our normal conduct of business, occupational Health and Safety is relevant to us because it impacts the welfare of our employees and their capacity to work for the company. We abide by safety, health, and welfare standards and policies set by the Department of Labor and Employment, as well as statutory benefits that our employees are entitled to. We recognize and accept its statutory responsibility to provide safe and healthy working conditions for employees, customers and other stakeholders who visit the Company’s premises, patronize its establishments, shop or dine its stores or may be affected by its activities.

Likewise, we have Security and Safety Manuals that are implemented and regularly reviewed to ensure the security, safety, health, and welfare of the employees in the workplace. To ensure the safety of our employees, a Corporate Emergency Response Team (CERT) has been created that will be activated and will become the “command center,” orchestrating initiatives across the conglomerate during a crisis. Also, the CERT shall be responsible for the periodic review of contingency plans and the institution’s emergency preparedness and response procedures to ensure that effective responses and responsible policies are in place to deal with crisis or emergency situations.

Program, COVID Protect, shots of AstraZeneca, Moderna, and Sinovac were administered to our employees and their chosen dependents. We believe that through these efforts and in support of government-led booster shot drives, we are on the road to moving forward beyond COVID-19.

As part of our normal conduct of business, occupational Health and Safety is relevant to us because it impacts the welfare of our employees and their capacity to work for the company. We abide by safety, health, and welfare standards and policies set by the Department of Labor and Employment, as well as statutory benefits that our employees are entitled to. We recognize and accept its statutory responsibility to provide safe and healthy working conditions for employees, customers and other stakeholders who visit the Company’s premises, patronize its establishments, shop or dine its stores or may be affected by its activities.

Likewise, we have Security and Safety Manuals that are implemented and regularly reviewed to ensure the security, safety, health, and welfare of the employees in the workplace. To ensure the safety of our employees, a Corporate Emergency Response Team (CERT) has been created that will be activated and will become the “command center,” orchestrating initiatives across the conglomerate during a crisis. Also, the CERT shall be responsible for the periodic review of contingency plans and the institution’s emergency preparedness and response procedures to ensure that effective responses and responsible policies are in place to deal with crisis or emergency situations.

As of end 2021, we are proud to share that 91% of our employees and third-party personnel

were inoculated with vaccines for COVID-19, with vaccination drives continuing into 2022. In partnership with local government units through the Gokongwei Group Vaccination Program, COVID Protect, shots of AstraZeneca, Moderna, and Sinovac were administered to our employees and their chosen dependents. We believe that through these efforts and in support of government-led booster shot drives, we are on the road to moving forward beyond COVID-19.

As part of our normal conduct of business, occupational Health and Safety is relevant to us because it impacts the welfare of our employees and their capacity to work for the company. We abide by safety, health, and welfare standards and policies set by the Department of Labor and Employment, as well as statutory benefits that our employees are entitled to. We recognize and accept its statutory responsibility to provide safe and healthy working conditions for employees, customers and other stakeholders who visit the Company’s premises, patronize its establishments, shop or dine its stores or may be affected by its activities.

Likewise, we have Security and Safety Manuals that are implemented and regularly reviewed to ensure the security, safety, health, and welfare of the employees in the workplace. To ensure the safety of our employees, a Corporate Emergency Response Team (CERT) has been created that will be activated and will become the “command center,” orchestrating initiatives across the conglomerate during a crisis. Also, the CERT shall be responsible for the periodic review of contingency plans and the institution’s emergency preparedness and response procedures to ensure that effective responses and responsible policies are in place to deal with crisis or emergency situations.

Employee Benefits

We are exploring ways to grow and retain talent by understanding the culture and priorities of a new breed of Millennial and Generation Z employees through open lines of communication between employees and their immediate supervisors, as well as creating an inclusive and flexible work environment that allows employees to create their own work routines and methods for productivity. We see increased engagement with a younger employee base is an opportunity for talent retention, as well as gaining deeper insight into factors that contribute to attrition.

We are exploring ways to grow and retain talent by understanding the culture and priorities of a new breed of Millennial and Generation Z employees through open lines of communication between employees and their immediate supervisors, as well as creating an inclusive and flexible work environment that allows employees to create their own work routines and methods for productivity. We see increased engagement with a younger employee base is an opportunity for talent retention, as well as gaining deeper insight into factors that contribute to attrition.

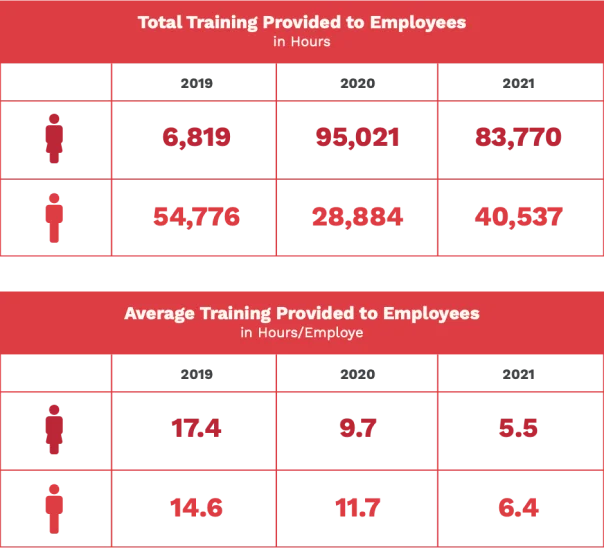

Employee Training and Development

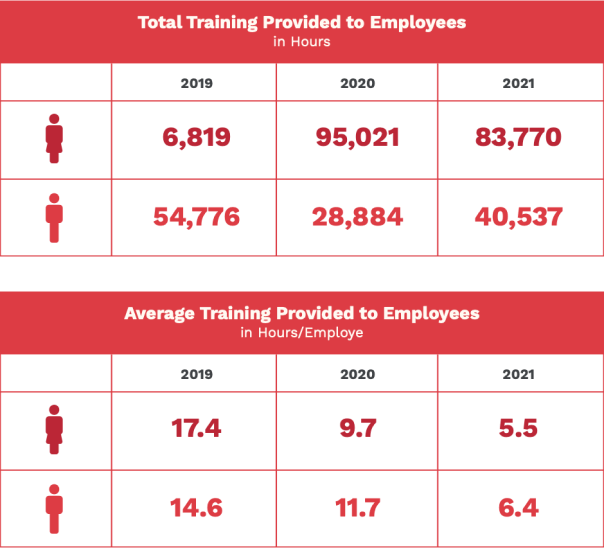

We have always been a believer of what continuous learning and development can do for its people and its businesses. Through various Learning and Development (L&D) activities, employees are provided with opportunities to develop, enhance, and enrich themselves with the skill sets they need to perform their roles effectively and efficiently in support of Robinsons Retail’s overall vision and mission. Through the Robinsons Retail Academy, the training arm of the entire Retail group, employees have year-round access to different programs, from basic courses offered to all employees, to highly specialized curricula offered to a targeted group.

Our training and development programs have led to substantial career growth among its employees, with internal promotions influencing performance from training programs. We believe career development is crucial in employee retention, and that employees should be empowered to feel that the successes of the company are their successes as well.

The reduction in 2020 and 2021 in training hours was due to community lockdowns and prohibitions in conducting face-to-face training programs. However, we implemented online-based courses to continue learning and development, with special attention to adjusting to the new normal of distance learning, familiarization with Microsoft Teams, and resilience and safety during the pandemic. We also believe that as face-to-face gatherings become more feasible, and as we collectively recover from the pandemic in the coming year, we can once again expand our training programs for

our employees.

The major programs being implemented by the academy include:

• Leadership courses from LinkedIn were introduced to empower Leadership through the pandemic.

• CORE, Curriculum on Retail Excellence, is a two- semester offering of basic soft skills courses for all regular employees of the subsidiaries.

• STEP, Store Trainee Enhancement Program, is RRHI’s Junior Management Traineeship program aimed at developing our future store supervisors.

• SMART, Store Manager’s Required Training, is a

highly customized 6-day curriculum for the most

critical talent in operations – our store managers.

• SMILE, Service Mileage, is our stores’ campaign to continuously deliver excellent service to our customers.

• General Training includes assemblies, strategy planning, exclusive learning and team collaboration sessions.

Every year, we conduct a Training Needs Assessment, the results of which serve as the basis of RRHI Human Resources and Robinsons Retail Academy, the training arm of RRHI, to design and develop new learning and further development opportunities.