Chairman &

President’s Message

Dear Shareholders,

We are pleased to share with you Robinsons Retail Holdings, Inc.’s 2021 Annual & Sustainability Report, which is our story of transformation and the road to recovery. This marks the second year of us navigating through the pandemic, and while COVID-19 continues to have lingering effects on industries and the economy, we at Robinsons Retail have always believed that a better normal is on the horizon.

In 2021, the Philippines posted a positive 5.7% growth in gross domestic product (GDP), signifying reinvigorated economic activity compared to the previous year with performance expected to further improve in 2022.

Indicators of growth were seen across various sectors. Bouncing back from the pandemic lull of 2020, the Construction, Manufacturing, and Wholesale and Retail trade sectors grew by 10.0%, 8.8% and 4.2% respectively, while Industry and Services grew by 8.5% and 5.4% respectively. Meanwhile, the business process outsourcing sector remained resilient despite on-off lockdowns with the transition to telecommuting, posting an estimated annual growth of around 9.0%.

Our optimism from encouraging signs of recovery comes with the awareness that businesses need to adapt to changing conditions, and indeed a new normal is being set in place as the coronavirus becomes an endemic presence in people’s lives. Throughout the past year, Robinsons Retail made leaps in its transformational journey to become even more digital, sustainable, and agile. By learning from the lessons of COVID-19, we were able to deliver value to our stakeholders in meaningful ways across our business units.

Financial Performance Highlights

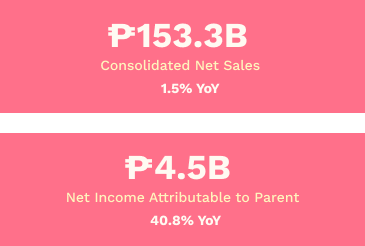

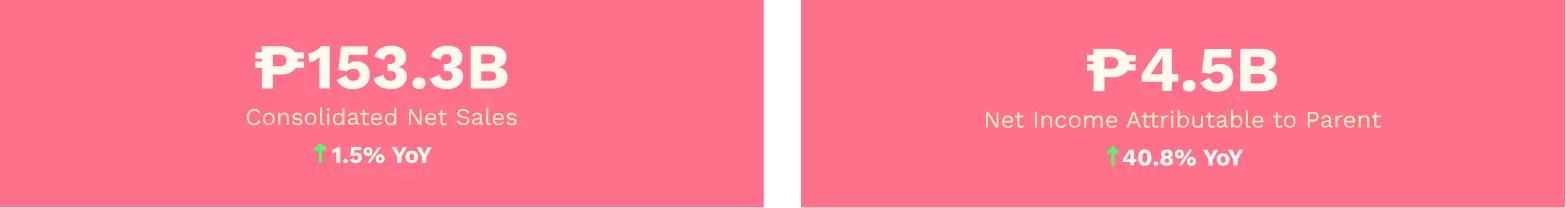

Our full-year productivity, though not yet back to pre-pandemic levels, showed stable growth with consolidated net sales growing by 1.5% year-on-year to Php153.3 billion in 2021, as we navigated through different levels of community quarantine that impacted consumer mobility and led to temporary store closures.

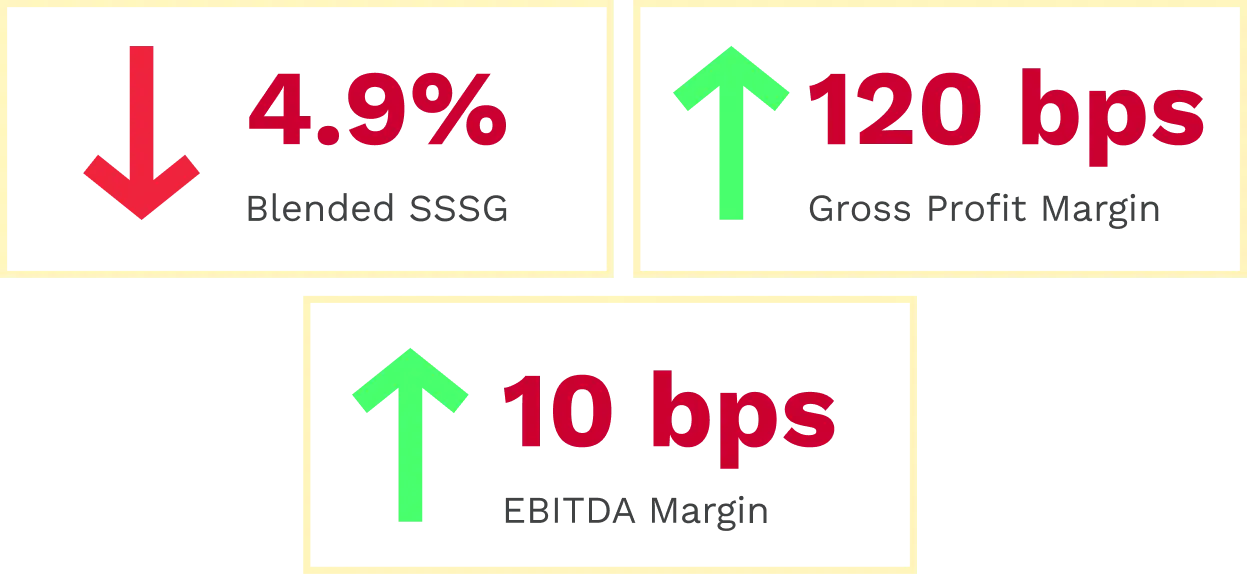

Our other performance indicators likewise showed notable improvement. Net income attributable to the Parent showed significant growth to Php4.5 billion, growing 40.8%, driven by the improved operating environment, forex gains, increased earnings from associates and lower income tax rate due to the CREATE Law. Although still negative at -4.9%, blended Same Store Sales Growth (SSSG) was better versus -8.9% in 2020. Gross profit margin rose 120 basis points (bps) to 23.0%, while Earnings before interest, taxes, depreciation (EBITDA) margin expanded by 10 bps to 8.6% to Php13.1 billion from cost containment measures.

As in previous years, the Supermarket Segment contributed the biggest portion of sales at 58%, albeit registering a decline in sales and SSSG given the higher base of 2020 which were driven by pantry loading at the peak of COVID panic. However, with the easing of restrictions especially in the fourth quarter of 2021, there was notable recovery in our drugstores, convenience stores, and the majority of our discretionary formats, which registered positive SSSG.

In 2021, the Philippines posted a positive 5.7% growth in gross domestic product (GDP), signifying reinvigorated economic activity compared to the previous year with performance expected to further improve in 2022.

Indicators of growth were seen across various sectors. Bouncing back from the pandemic lull of 2020, the Construction, Manufacturing, and Wholesale and Retail trade sectors grew by 10.0%, 8.8% and 4.2% respectively, while Industry and Services grew by 8.5% and 5.4% respectively. Meanwhile, the business process outsourcing sector remained resilient despite on-off

lockdowns with the transition to telecommuting, posting an estimated annual growth of around 9.0%.

Our optimism from encouraging signs of recovery comes with the awareness that businesses need to adapt to changing conditions, and indeed a new normal is being set in place as the coronavirus becomes an endemic presence in people’s lives. Throughout the past year, Robinsons Retail made leaps in its transformational journey to become even more digital, sustainable, and agile. By learning from the lessons of COVID-19, we were able to deliver value to our stakeholders in meaningful ways across our business units.

Financial Performance

Highlights

Our full-year productivity, though not yet back to pre-pandemic levels, showed stable growth with consolidated net sales growing by 1.5% year-on-year to Php153.3 billion in 2021, as we navigated through different levels of community quarantine that impacted consumer mobility and led to temporary store closures.

Our other performance indicators likewise showed notable improvement. Net income attributable to the Parent showed significant growth to Php4.5 billion, growing 40.8%, driven by the improved operating environment, forex gains, increased earnings from associates and lower income tax rate due to the CREATE Law. Although still negative at -4.9%, blended Same Store Sales Growth (SSSG) was better versus -8.9% in 2020. Gross profit margin rose 120 basis points (bps) to 23.0%, while Earnings before interest, taxes, depreciation (EBITDA) margin expanded by 10 bps to 8.6% to Php13.1 billion from cost containment measures.

As in previous years, the Supermarket Segment contributed the biggest portion of sales at 58%, albeit registering a decline in sales and SSSG given the higher base of 2020 which were driven by pantry loading at the peak of COVID panic. However, with the easing of restrictions especially in the fourth quarter of 2021, there was notable recovery in our drugstores, convenience stores, and the majority of our discretionary formats, which registered positive SSSG.

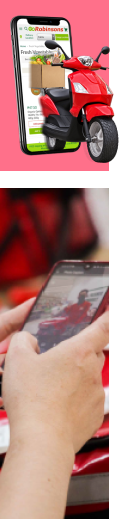

In our e-commerce business, sales grew three times (3x) year-on-year, representing 3.6% of total sales, bolstered by the momentum of online shopping through our own e-commerce websites, third-party marketplace partnerships, and call & collect.

In our e-commerce business, sales grew three times (3x) year-on-year, representing 3.6% of total sales, bolstered by the momentum of online shopping through our own e-commerce websites, third-party marketplace partnerships, and call & collect

Captivating the

Omnichannel Consumer

Of the lessons we learned from the disruption of COVID-19, perhaps the most relevant is the affirmation that technology and digitalization is set to shape and reshape the Philippine retail industry. Our accelerated adoption of e-commerce, which was established during the height of the pandemic, will remain relevant in a post-COVID reality and a more open economy.

As we opened new stores across our banners, we on-boarded our banners in GoRobinsons, our very own e-commerce site. We ended 2021 with 11 banners on the platform and gross merchandise value (GMV) grew by around 7x year-on-year, showing substantial uptake as we succeeded in capturing an emerging demographic of online shoppers. GoRobinsons is integrated with our loyalty program, GoRewards, which currently has over five million members nationwide. Customers can earn points and take advantage of targeted promotions, giving more value with their purchases.

In addition to GoRobinsons, our mainstream drugstore and appliances banners also operate their own e-commerce sites, and the majority of our formats are also present in third party marketplaces and have call & collect services.

We believe that we are capturing a market that itself is evolving through the times, as the modern consumer becomes more and more used to the conveniences of online shopping, but also values the experiential and tactile qualities of a physical store. We recognize the irreplaceable role of brick and mortar in our growth strategy, as there are yet more underserved areas in the country where modern retail carries potential, particularly in provinces and cities outside Metro Manila.

Our strategy remains, where we build the foundations of omnichannel. We will open more physical stores to fulfill their purpose of bringing access to quality products and services in areas where it is the best model to serve customers and communities. At the same time, we will accelerate our online initiatives to remain relevant in the fast-paced and competitive space of e-commerce, leveraging on the trust we have cultivated with our customers through the Robinsons brand.

While some vectors of business strategically headed towards online, we also saw the transition of a purely online business to brick and mortar. Through collaboration with BeautyMNL, our first digital investment in e-commerce where we currently have 30% stake, we launched the first BeautyMNL shop-in-shop in selected branches of Robinsons Department Store and The Marketplace. BeautyMNL is the leading pure Filipino beauty e-commerce platform in the country, and the shop-in-shop concept features their bestselling cosmetics and personal care, allowing them to tap into the offline market as well.

Our investments in digital partners allow us to gain a deeper understanding of the dynamism in online marketplaces, making us more capable to expand our digital footprint.

Of the lessons we learned from the disruption of COVID-19, perhaps the most relevant is the affirmation that technology and digitalization is set to shape and reshape the Philippine retail industry. Our accelerated adoption of e-commerce, which was established during the height of the pandemic, will remain relevant in a post-COVID reality and a more open economy.

As we opened new stores across our banners, we on-boarded our banners in GoRobinsons, our very own e-commerce site. We ended 2021 with 11 banners on the platform and gross merchandise value (GMV) grew by around 7x year-on-year, showing substantial uptake as we succeeded in capturing an emerging demographic of online shoppers. GoRobinsons is integrated with our loyalty program, GoRewards, which currently has over five million members nationwide. Customers can earn points and take advantage of targeted promotions, giving more value with their purchases.

In addition to GoRobinsons, our mainstream drugstore and appliances banners also operate their own e-commerce sites, and the majority of our formats are also present in third party marketplaces and have call & collect services.

We believe that we are capturing a market that itself is evolving through the times, as the modern consumer becomes more and more used to the conveniences of online shopping, but also values the experiential and tactile qualities of a physical store. We recognize the irreplaceable role of brick and mortar in our growth strategy, as there are yet more underserved areas in the country where modern retail carries potential, particularly in provinces and cities outside Metro Manila.

Our strategy remains, where we build the foundations of omnichannel. We will open more physical stores to fulfill their purpose of bringing access to quality products and services in areas where it is the best model to serve customers and communities. At the same time, we will accelerate our online initiatives to remain relevant in the fast-paced and competitive space of e-commerce, leveraging on the trust we have cultivated with our customers through the Robinsons brand.

While some vectors of business strategically headed towards online, we also saw the transition of a purely online business to brick and mortar. Through collaboration with BeautyMNL, our first digital investment in e-commerce where we currently have 30% stake, we launched the first BeautyMNL shop-in-shop in selected branches of Robinsons Department Store and The Marketplace. BeautyMNL is the leading pure Filipino beauty e-commerce platform in the country, and the shop-in-shop concept features their bestselling cosmetics and personal care, allowing them to tap into the offline market as well.

Our investments in digital partners allow us to gain a deeper understanding of the dynamism in online marketplaces, making us more capable to expand our digital footprint.

Intuitive Digital

Investments

We have seen meaningful success in GrowSari, which is operated by one of our notable digital investments, G2M Solutions Philippines, Inc. (G2M). GrowSari promotes inclusive business through providing stock replenishment services to around 50,000 sari-sari store owners in the Philippines. Our partnership manifested intuitive synergies, with GrowSari sourcing its merchandise from our supermarkets, and it is currently leading the pack in the digital space for B2B services for small business owners.

In June 2021, G2M closed its Series B funding round, raising US$30+ million in total funding from global marquee investors. This raised its pre-money valuation 3.6x from its 2018 Series A funding.

Robinsons Retail joined G2M’s Series A in 2018 and also participated in Series B, maintaining its share in G2M at 14.16%. The funding is expected to fuel GrowSari’s geographic expansion to cover 300,000 sari-sari stores, create a larger supplier marketplace, and provide more financial service offerings.

We have seen meaningful success in GrowSari, which is operated by one of our notable digital investments, G2M Solutions Philippines, Inc. (G2M). GrowSari promotes inclusive business through providing stock replenishment services to around 50,000 sari-sari store owners in the Philippines. Our partnership manifested intuitive synergies, with GrowSari sourcing its merchandise from our supermarkets, and it is currently leading the pack in the digital space for B2B services for small business owners.

In June 2021, G2M closed its Series B funding round, raising US$30+ million in total funding from global marquee investors. This raised its pre-money valuation 3.6x from its 2018 Series A funding.

Robinsons Retail joined G2M’s Series A in 2018 and also participated in Series B, maintaining its share in G2M at 14.16%. The funding is expected to fuel GrowSari’s geographic expansion to cover 300,000 sari-sari stores, create a larger supplier marketplace, and provide more financial service offerings.

In line with our strategy and pivot into e-commerce, we invested in Edamama, with 13.3% equity ownership upon conversion. Established in 2020, Edamama is a new e-commerce platform designed for mothers to get easy online access to quality child care products. Our investment in Edamama is a strategic fit as it allows us to explore potential collaborations with Robinsons Department Store and Toys ‘R’ Us.

A digital world awaits retail and technology heavily informs our long-term vision for the company. But alongside the digital, we also believe in the sustainable, where Robinsons Retail operates with integrity as a company that takes into account its impacts to society.

Our responses to the pandemic form part of our commitment to Sustainability that focuses on human capital. When the pandemic started, we prioritized the safety of our employees and we will sustain this effort throughout its duration and under normal

operating conditions.

From our frontliners to our support services, we have always been keenly aware that our people and their talent are our greatest asset in the company, and we are grateful for the dedication they have shown. Although we may breathe easier now as we make progress in vaccination and have adopted proper protocols in case infections do occur, we remain vigilant in safeguarding our health as we wade through the possibility of new variants emerging that may prolong the pandemic.

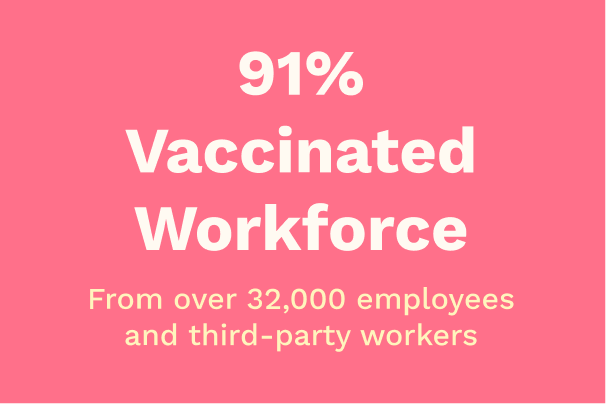

We affirm the position that vaccinations offer a significant layer of protection for individuals and communities. As of end 2021, 91% of our over 32,000 employees and third-party workers were vaccinated

through partnerships with Local Government Units and the Gokongwei Group’s vaccination program, COVID Protect. The program correspondingly extended vaccines to

their chosen dependents and household members, giving collective security to as many people as possible.

Further bolstering our capabilities in managing ESG (environment, social,

and governance) impacts, we deepened our understanding of Enterprise Risk Management (ERM) through the lens

of sustainability. We are forming the foundations to enhance our disclosures

in sustainability while taking into account key material trends, emphasizing risks and opportunities that are material to Robinsons Retail and its business units. Lastly, we established the Corporate Governance and Sustainability Committee, signifying to our stakeholders that sustainability is a relevant aspect in the long-term views of Robinsons Retail at the level of the Board.

Our responses to the pandemic form part of our commitment to Sustainability that focuses on human capital. When the pandemic started, we prioritized the safety of our employees and we will sustain this effort throughout its duration and under normal operating conditions.

From our frontliners to our support services, we have always been keenly aware that our people and their talent are our greatest asset in the company, and we are grateful for the dedication they have shown. Although we may breathe easier now as we make progress in vaccination and have adopted proper protocols in case infections do occur, we remain vigilant in safeguarding our health as we wade through the possibility of new variants emerging that may prolong the pandemic.

We affirm the position that vaccinations offer a significant layer of protection for individuals and communities. As of end 2021, 91% of our over 32,000 employees and third-party workers were vaccinated through partnerships with Local Government Units and the Gokongwei Group’s vaccination program, COVID Protect. The program correspondingly extended vaccines to their chosen dependents and household members, giving collective security to as many people as possible.

Further bolstering our capabilities in managing ESG (environment, social, and governance) impacts, we deepened our understanding of Enterprise Risk Management (ERM) through the lens of sustainability. We are forming the foundations to enhance our disclosures in sustainability while taking into account key material trends, emphasizing risks and opportunities that are material to Robinsons Retail and its business units. Lastly, we established the Corporate Governance and Sustainability Committee, signifying to our stakeholders that sustainability is a relevant aspect in the long-term views of Robinsons Retail at the level of the Board.

Recognition in Gender Equality

Recognition in Gender Equality

Robinsons Retail has always been a space of merit, and we constantly strive to foster inclusive spaces where anyone can prosper regardless of gender.

At present, Robinsons Retail’s employee base is 70% women, with female employees fulfilling leadership roles across all levels of management, including the Chief Financial Officer, Corporate Secretary, and Head of Corporate Planning, Investor Relations and Sustainability; a total of 6 out of 11 of our Business Unit Heads.

We are happy that the Company was recognized by Corporate Women Directors International (CWDI) as one of the World’s top 10 companies led by women. CWDI is a nonprofit organization based in Washington, which surveyed nearly 3,000 companies in 55 countries to generate baseline data on women in leadership roles.

More recently, on January 26, 2022, Robinsons Retail Holdings, Inc. marked its inclusion in the Bloomberg LP Gender Equality Index (GEI) 2022, which is based on the social data of companies in 2020. The GEI is a modified market capitalization-weighted index that aims to track the performance of public companies committed to

transparency in gender-data reporting across five dimensions: female leadership & talent pipeline; equal pay and gender pay parity; inclusive culture; anti-sexual harassment policies; and pro-women brand. The current list comprises 418 companies across 11 sectors and 45 countries, with Robinsons Retail being one of only four Filipino companies in the 2022 GEI.

Robinsons Retail shall strive to sustain this culture of empowerment, where it can serve as a place for personal and collective growth.

Robinsons Retail has always been a space of merit, and we constantly strive to foster inclusive spaces where anyone can prosper regardless of gender.

At present, Robinsons Retail’s employee base is 70% women, with female employees fulfilling leadership roles across all levels of management, including the Chief Financial Officer, Corporate Secretary, and Head of Corporate Planning, Investor Relations and Sustainability; a total of 6 out of 11 of our Business Unit Heads.

We are happy that the Company was recognized by Corporate Women Directors International (CWDI) as one of the World’s top 10 companies led by women. CWDI is a nonprofit organization based in Washington, which surveyed nearly 3,000 companies in 55 countries to generate baseline data on women in leadership roles.

More recently, on January 26, 2022, Robinsons Retail Holdings, Inc. marked its inclusion in the Bloomberg LP Gender Equality Index (GEI) 2022, which is based on the social data of companies in 2020. The GEI is a modified market capitalization-weighted index that aims to track the performance of public companies committed to

transparency in gender-data reporting across five dimensions: female leadership & talent pipeline; equal pay and gender pay parity; inclusive culture; anti-sexual harassment policies; and pro-women brand. The current list comprises 418 companies across 11 sectors and 45 countries, with Robinsons Retail being one of only four Filipino companies in the 2022 GEI.

Robinsons Retail shall strive to sustain this culture of empowerment, where it can serve as a place for personal and collective growth.

Hope and Resilience in 2022

We hold onto a hopeful outlook for the year, despite the immediate headwinds that emerged within the first quarter of 2022. While challenges are inevitable, we will rely on our agility as a business to remain resilient in the face of any circumstance.

In January, the country experienced a surge in Omicron cases, leading to a strict albeit temporary lockdown. However, we believe that the nation is better equipped to mitigate and contain COVID-19. Given the notable improvements in vaccination roll-outs to around 63% of the population as of end 2021, the majority of cases were less severe than in initial waves of infection. The inoculation efforts and the strengthening of the healthcare system subsequently inform the lifting of restrictions. We expect to see more consumer confidence for the rest of the year, as well as a resurgence in consumption with the resumption of onsite work arrangements and face to face classes at schools.

As we are writing the report, the ongoing conflict between Ukraine and Russia is a point of precaution, with the immediate impact seen through rising oil prices and higher inflation rates across the globe. As a retail business, inflation offers a temporary uplift in margins through the price protection policies, however, extreme inflation negatively impacts consumers and businesses in the long-term, and the government is likely to intervene through tighter monetary policies. For our price-sensitive customers, we will seek ways to offer options that will still address their needs, as well as implement internal controls to manage costs in our operations.

2022 is an election year. Based on previous electoral seasons, these usually usher in a period of heightened economic activity that ultimately benefits the retail sector. The National Presidential Elections results will likewise carry implications on the future of governance for the country. As a company, Robinsons Retail sees its role in the private sector as a sustainable corporation that has remained intact and collaborative across various shifts in regime. We are hopeful in this next phase in Philippine history for the Filipino people, and whatever its results, Robinsons Retail will do its best to be a partner for development.

As a Company, we mourn the loss of our Independent Director, Ambassador Roberto R. Romulo, who passed away on January 23, 2022. He was elected as Independent Director on July 4, 2013, having paved an illustrious career with notable work and chairmanships across various corporations and organizations. We are grateful for Mr. Romulo’s immeasurable contributions to Robinsons Retail. In his capacity, he shared his invaluable insight and expertise across various aspects of the business.

At this point, we acknowledge and thank our diverse stakeholders in this message and report, which is dedicated to the vast number of individuals and partners who have made Robinsons Retail what it is today. We chose the theme “The Greater Goods” for this report with our shareholders, customers, employees, and partners in mind, highlighting our aspirations to always deliver greater value to the best of our ability. We face a big year ahead of us, and we hope that you will be with us for what milestones we have yet to achieve.

Thank you and forever and always, happy shopping!

Sincerely,

We hold onto a hopeful outlook for the year, despite the immediate headwinds that emerged within the first quarter of 2022. While challenges are inevitable, we will rely on our agility as a business to remain resilient in the face of any circumstance.

In January, the country experienced a surge in Omicron cases, leading to a strict albeit temporary lockdown. However, we believe that the nation is better equipped to mitigate and contain COVID-19. Given the notable improvements in vaccination roll-outs to around 63% of the population as of end 2021, the majority of cases were less severe than in initial waves of infection. The inoculation efforts and the strengthening of the healthcare system subsequently inform the lifting of restrictions. We expect to see more consumer confidence for the rest of the year, as well as a resurgence in consumption with the resumption of onsite work arrangements and face to face classes at schools.

As we are writing the report, the ongoing conflict between Ukraine and Russia is a point of precaution, with the immediate impact seen through rising oil prices and higher inflation rates across the globe. As a retail business, inflation offers a temporary uplift in margins through the price protection policies, however, extreme inflation negatively impacts consumers and businesses in the long-term, and the government is likely to intervene through tighter monetary policies. For our price-sensitive customers, we will seek ways to offer options that will still address their needs, as well as implement internal controls to manage costs in our operations.

2022 is an election year. Based on previous electoral seasons, these usually usher in a period of heightened economic activity that ultimately benefits the retail sector. The National Presidential Elections results will likewise carry implications on the future of governance for the country. As a company, Robinsons Retail sees its role in the private sector as a sustainable corporation that has remained intact and collaborative across various shifts in regime. We are hopeful in this next phase in Philippine history for the Filipino people, and whatever its results, Robinsons Retail will do its best to be a partner for development.

As a Company, we mourn the loss of our Independent Director, Ambassador Roberto R. Romulo, who passed away on January 23, 2022. He was elected as Independent Director on July 4, 2013, having paved an illustrious career with notable work and chairmanships across various corporations and organizations. We are grateful for Mr. Romulo’s immeasurable contributions to Robinsons Retail. In his capacity, he shared his invaluable insight and expertise across various aspects of the business.

At this point, we acknowledge and thank our diverse stakeholders in this message and report, which is dedicated to the vast number of individuals and partners who have made Robinsons Retail what it is today. We chose the theme “The Greater Goods” for this report with our shareholders, customers, employees, and partners in mind, highlighting our aspirations to always deliver greater value to the best of our ability. We face a big year ahead of us, and we hope that you will be with us for what milestones we have yet to achieve.

Thank you and forever and always, happy shopping!

Sincerely,

Management

Discussion & Analysis

E-commerce sales provided a substantial contribution as it grew three times (3x) compared to the previous year and accounted for 3.6% of total sales. GoRobinsons, Robinsons Retail’s e-commerce platform, now services 11 banners. Meanwhile, Southstar Drug, Rose Pharmacy, Robinsons Appliances, and Savers Appliances continued to serve customers via their own websites. Selling via third party platforms also remained an important component in the company’s efforts to widen its channels to reach customers better. Call & Collect and Call & Deliver services also provided valuable integrated access points for our products.

Robinsons Retail also further increased its online presence through its digital investments. The company invested in Edamama, a new e-commerce platform for mothers to get easy access to quality childcare products and services. Meanwhile, BeautyMNL, the country’s leading beauty e-commerce site, continued making marks in its own e-commerce space while it also tapped the offline market with the introduction of shop-in-shop concept stores. Additionally, Data Analytics Ventures, Inc. (DAVI), a data analytics company that provides consumer insights for precision marketing and omnichannel campaigns-based data from the group’s loyalty program Go Rewards, continued to support Robinsons Retail. Go Rewards now has more than 5 million members.

Robinsons Retail also participated in the Series B funding round of Growsari, a B2B platform engaged in selling wholesale goods to sari-sari stores, which also sources products from Robinsons Supermarket. In 2018, Robinsons Retail led Growsari’s Series A fundraising, along with JG Digital Equity Ventures (JGDEV) and Wavemaker Partners LLC. For Series B, Growsari raised a total of more than $30 million. As of year-end, Robinsons Retail’s stake in Growsari was at 14.16%.

E-commerce sales provided a substantial contribution as it grew three times (3x) compared to the previous year and accounted for 3.6% of total sales. GoRobinsons, Robinsons Retail’s e-commerce platform, now services 11 banners. Meanwhile, Southstar Drug, Rose Pharmacy, Robinsons Appliances, and Savers Appliances continued to serve customers via their own websites. Selling via third party platforms also remained an important component in the company’s efforts to widen its channels to reach customers better. Call & Collect and Call & Deliver services also provided valuable integrated access points for our products.

Robinsons Retail also further increased its online presence through its digital investments. The company invested in Edamama, a new e-commerce platform for mothers to get easy access to quality childcare products and services. Meanwhile, BeautyMNL, the country’s leading beauty e-commerce site, continued making marks in its own e-commerce space while it also tapped the offline market with the introduction of shop-in-shop concept stores. Additionally, Data Analytics Ventures, Inc. (DAVI), a data analytics company that provides consumer insights for precision marketing and omnichannel campaigns-based data from the group’s loyalty program Go Rewards, continued to support Robinsons Retail. Go Rewards now has more than 5 million members.

Robinsons Retail also participated in the Series B funding round of Growsari, a B2B platform engaged in selling wholesale goods to sari-sari stores, which also sources products from Robinsons Supermarket. In 2018, Robinsons Retail led Growsari’s Series A fundraising, along with JG Digital Equity Ventures (JGDEV) and Wavemaker Partners LLC. For Series B, Growsari raised a total of more than $30 million. As of year-end, Robinsons Retail’s stake in Growsari was at 14.16%.

Robinsons Retail opened 135 new stores in 2021, closed a number of underperforming stores, and also completed the closure of the global fast fashion stores when its principal Arcadia UK Ltd. went into administration. The total store count as of end-2021 reached 2,208, composed of 286 supermarkets, 899 drugstores, 52 department stores, 227 DIY stores, 456 convenience stores, and 288 specialty stores. The specialty stores consist of 121 appliances, 108 mass merchandise, 41 toys, 14 beauty and 4 pets stores. On top of total stores are 2,030 franchised stores of TGP.

Blended Same Store Sales Growth (SSSG) ended at minus 4.9%, an improvement against 2020’s minus 8.9%. Department store, DIY, and Specialty segments rebounded with positive SSSG in 2021. Supermarket segment, on the other hand, posted negative SSSG coming from a high base while the drugstore segment registered flattish SSSG.

Gross profit margin expanded 120 basis points (bps) to 23.0% from higher vendor support and better product mix almost across segments. EBITDA margin likewise improved by 10bps to 8.6% supported by efforts to reduce costs and yield more savings.

Net income attributable to the equity holders of the parent company hit Php4.5 billion, up by 40.8% versus 2020. Bottomline expansion was driven by better operating performance, forex gains, increased earnings from associates and lower income tax rate.

Robinsons Retail opened 135 new stores in 2021, closed a number of underperforming stores, and also completed the closure of the global fast fashion stores when its principal Arcadia UK Ltd. went into administration. The total store count as of end-2021 reached 2,208, composed of 286 supermarkets, 899 drugstores, 52 department stores, 227 DIY stores, 456 convenience stores, and 288 specialty stores. The specialty stores consist of 121 appliances, 108 mass merchandise, 41 toys, 14 beauty and 4 pets stores. On top of total stores are 2,030 franchised stores of TGP.

Blended Same Store Sales Growth (SSSG) ended at minus 4.9%, an improvement against 2020’s minus 8.9%. Department store, DIY, and Specialty segments rebounded with positive SSSG in 2021. Supermarket segment, on the other hand, posted negative SSSG coming from a high base while the drugstore segment registered flattish SSSG.

Gross profit margin expanded 120 basis points (bps) to 23.0% from higher vendor support and better product mix almost across segments. EBITDA margin likewise improved by 10bps to 8.6% supported by efforts to reduce costs and yield more savings.

Net income attributable to the equity holders of the parent company hit Php4.5 billion, up by 40.8% versus 2020. Bottomline expansion was driven by better operating performance, forex gains, increased earnings from associates and lower income tax rate.

Supermarket

The supermarket segment, which includes No Brand and Growsari starting 2021, posted net sales of Php88.6 billion, down 5.8% from the previous year. Full year

SSSG was at minus 8.7% given the heavy pantry loading in 2020 when the lockdowns started in mid-March, along with the evident rise of social commerce. Renovations in key Shopwise and The Marketplace stores also affected sales in 2021 but will see fruit in 2022. Meanwhile, e-commerce tripled in 2021, accounting for 3.7% of sales, above the 2.4% target.

Gross margin was 21.5% in 2021, 60bps higher than the 20.9% in 2020. Excluding the consolidation of Growsari and No Brand, gross margin expanded by 120bps to 22.1%, attributable to stronger advertising support for category promotions, higher business advancement support for new stores, and increased revenues from new product listings.

The gains in gross margins trickled down to EBITDA margins, reaching 8.4%, a 10bps increase from 2020.

The segment ended the year with 145 Robinsons Supermarket, 80 Robinsons Easymart, 34 The Marketplace, 16 Shopwise, and 11 No Brand stores for a total of 286 stores. All five banners have been onboarded in GoRobinsons.ph. The supermarket segment has also continued to partner with third party grocery delivery services.

Supermarket

The supermarket segment, which includes No Brand and Growsari starting 2021, posted net sales of Php88.6 billion, down 5.8% from the previous year. Full year SSSG was at minus 8.7% given the heavy pantry loading in 2020 when the lockdowns started in mid-March, along with the evident rise of social commerce. Renovations in key Shopwise and The Marketplace stores also affected sales in 2021 but will see fruit in 2022. Meanwhile, e-commerce tripled in 2021, accounting for 3.7% of sales, above the 2.4% target.

Gross margin was 21.5% in 2021, 60bps higher than the 20.9% in 2020. Excluding the consolidation of Growsari

and No Brand, gross margin expanded by 120bps to 22.1%, attributable to stronger advertising support for category promotions, higher business advancement support for new stores, and increased revenues from new

product listings.

The gains in gross margins trickled down to EBITDA margins, reaching 8.4%, a 10bps increase from 2020. The segment ended the year with 145 Robinsons Supermarket, 80 Robinsons Easymart, 34 The Marketplace, 16 Shopwise, and 11 No Brand stores for a total of 286 stores. All five banners have been onboarded in GoRobinsons.ph. The supermarket segment has also continued to partner with third party grocery delivery services.

Drugstore

The drugstore segment delivered strong net sales in 2021 that surged 39.9% to Php26.7 billion. Rose Pharmacy contributed full-year sales of Php8.2 billion

in 2021 compared to Php1.2 billion for the last two months in 2020 (Robinsons Retail acquired Rose in the last week of October 2020). E-commerce contribution likewise grew to 4.4% of total sales, ahead of the 4.1% target.

SSSG ended flattish for the year. First quarter 2021 SSSG was exceptionally low as it was coming from a high base in the same period last year due to the surge in offtake of vitamins and medical supplies caused by the effects of the Taal eruption and panic buying due to the onset of the pandemic. This was, however, fully covered by the strong performance in the last three quarters with higher demand for anti-diabetes, respiratory, and cardiovascular pharma products.

Blended gross margins increased by 50bps to 19.5% versus 2020 as a result of

trading terms alignment and other supply chain synergies between Southstar Drug and Rose Pharmacy. As early as March 2021, Rose Pharmacy saw an increase in the gross margin due to the buying synergies with Southstar Drug and TGP that resulted in a positive EBIT performance after years of losses.

The segment’s EBITDA margin still declined by 70bps to 8.6% given the full year impact of Rose Pharmacy versus only two months in 2020. Excluding Rose Pharmacy, EBITDA margin improved 10bps compared to 2020.

As of end-December, there were 582 SouthStar, 317 Rose Pharmacy, and 2,030 TGP stores. Southstar Drug onboarded GoRobinsons in December 2021 while continuing to operate its own e-commerce website, southstardrug.com.ph. Rose Pharmacy also has its own website, rosepharmacy.com.ph.

The DIY segment posted net sales of Php11.5 billion, up 1.3% from the previous year. DIY stores were considered essential under the restriction guidelines in 2021 and were fully operational.

Meanwhile, e-commerce sales grew 2.5x, which contributed 3.7% of sales, above the 2.5% target.

SSSG was parallel to net sales growth at 1.3%. Categories that performed favorably were small appliances, tools, and cleaning supplies.

The full year gross margin was down 90bps to 31.6% due to more promotional events for the year. This translated to an EBITDA margin of 13.5%.

The DIY portfolio totaled 227 stores, comprising

180 Handyman Do-It-Best, 31 True Value, and 16 Robinsons Builders stores. Handyman Do-It-Best and True Value were onboarded in GoRobinsons.ph in 2021. DIY products can also be accessed through the Call & Collect and Call & Deliver services.

Net sales of the Department Store segment significantly grew by 10.4% to Php9.3 billion. SSSG remarkably turned around at 8.7% compared to the negative SSSG in 2020, driven by strong performance in all categories, especially Home Goods.

E-commerce sales doubled and was at 1.4% of total sales. In addition, three newly-opened stores in Robinsons Malls in La Union, Antique, and Tacloban also contributed to the strong topline performance.

The gross margin expanded by

40 bps to 29.9% due to a better category mix. Coupled with lower operating expenses resulting from the implementation of cost-cutting measures, EBITDA margins accelerated 330bps to 6.6%.

With the addition of the three provincial stores, Robinsons Department store ended the year with 52 stores. Its products can also be reached through GoRobinsons. ph and its Call & Collect and Call & Deliver services.

Ministop ended 2021 with Php4.9 billion in net sales. The convenience store segment was still highly affected by the pandemic as about 55% of its stores are located in business process outsourcing (BPO) and commercial districts where employees were on work-from-home (WFH) arrangements during most parts of the year. Sales also declined during the imposition of the 10pm-5am curfew in NCR that started on March 15th to March 28th, followed by ECQ on March 29th, which resulted in -33.4% SSSG in the first quarter. SSSG steadily improved from the second to the fourth quarter to narrow down the full-year SSSG to -9.6%. Meanwhile, E-commerce as a percentage of total sales rose to 2.7% from 0.9% the previous year.

Gross margin and royalty income expanded to 35.4% in 2021 driven by the increase in commission income and distribution center (DC) allowance. Commissions from value-added services such as telco, bills payments, and cash-ins gained traction, accounting for 1.5% of sales from 0.9% in 2020.

EBITDA margins declined by 70bps to 5.9% in 2021 as OPEX grew with the conversion of several franchised stores to direct.

As of year-end, Ministop had 456 store branches and provides online delivery services.

Speciality Stores

The specialty stores segment registered Php12.3 billion in sales in 2021. Sales declined by 7.4% due to the closure of the fashion segment and the reclassification of Growsari and No Brand to the supermarket segment.

SSSG showed tremendous progress, ending at 6.0%, a turnaround from the minus 28.0% it suffered in 2020. All specialty store formats contributed positive SSSG for the year. E-commerce sales also grew 63% and accounted for 3.0% of sales.

Blended gross margin rose by 400bps to 24.6% and EBITDA margins likewise expanded by 150bps to 7.9%.

The specialty stores portfolio totaled 288 as of end 2021. Robinsons Appliances and Savers Appliances have their own e-commerce websites — robinsonsappliances.com.ph and saversappliances. com.ph. Meanwhile, Shiseido joined GoRobinsons.ph in 2021. Toy ‘R’ Us also has Call & Collect and Call & Deliver services.

Drugstore

The drugstore segment delivered strong net sales in 2021 that surged 39.9% to Php26.7 billion. Rose Pharmacy contributed full-year sales of Php8.2 billion in 2021 compared to Php1.2 billion for the last two months in 2020 (Robinsons Retail acquired Rose in the last week of October 2020). E-commerce contribution likewise grew to 4.4% of total sales, ahead of the 4.1% target.

SSSG ended flattish for the year. First quarter 2021 SSSG was exceptionally low as it was coming from a high base in the same period last year due to the surge in offtake of vitamins and medical supplies caused by the effects of the Taal eruption and panic buying due to the onset of the pandemic. This was, however, fully covered by the strong performance in the last three quarters with higher demand for anti-diabetes, respiratory, and cardiovascular pharma products.

Blended gross margins increased by 50bps to 19.5% versus 2020 as a result of trading terms alignment and other supply chain synergies between Southstar Drug and Rose Pharmacy. As early as March 2021, Rose Pharmacy saw an increase in the gross margin due to the buying synergies with Southstar Drug and TGP that resulted in a positive EBIT performance after years of losses.

The segment’s EBITDA margin still declined by 70bps to 8.6% given the full year impact of Rose Pharmacy versus only two months in 2020. Excluding Rose Pharmacy, EBITDA margin improved 10bps compared to 2020.

As of end-December, there were 582 SouthStar, 317 Rose Pharmacy, and 2,030 TGP stores. Southstar Drug onboarded GoRobinsons in December 2021 while continuing to operate its own e-commerce website, southstardrug.com.ph. Rose Pharmacy also has its own website, rosepharmacy.com.ph.

DIY & Big Box Hardware

The DIY segment posted net sales of Php11.5 billion, up 1.3% from the previous year. DIY stores were considered essential under the restriction guidelines in 2021 and were fully operational. Meanwhile, e-commerce sales grew 2.5x, which contributed 3.7% of sales, above the 2.5% target.

SSSG was parallel to net sales growth at 1.3%. Categories that performed favorably were small appliances, tools, and cleaning supplies.

The full year gross margin was down 90bps to 31.6% due to more promotional events for the year. This translated to an EBITDA margin of 13.5%.

The DIY portfolio totaled 227 stores, comprising 180 Handyman Do-It-Best, 31 True Value, and 16 Robinsons Builders stores. Handyman Do-It-Best and True Value were onboarded in GoRobinsons.ph in 2021. DIY products can also be accessed through the Call & Collect and Call & Deliver services.

Department Store

Net sales of the Department Store segment significantly grew by 10.4% to Php9.3 billion. SSSG remarkably turned around at 8.7% compared to the negative SSSG in 2020, driven by strong performance in all categories, especially Home Goods. E-commerce sales doubled and was at 1.4% of total sales. In addition, three newly-opened stores in Robinsons Malls in La Union, Antique, and Tacloban also contributed to the strong topline performance.

The gross margin expanded by 40 bps to 29.9% due to a better category mix. Coupled with lower operating expenses resulting from the implementation of cost-cutting measures, EBITDA margins accelerated 330bps to 6.6%.

With the addition of the three provincial stores, Robinsons Department store ended the year with 52 stores. Its products can also be reached through GoRobinsons.ph and its Call & Collect and Call & Deliver services.

Convenience Stores

Ministop ended 2021 with Php4.9 billion in net sales. The convenience store segment was still highly affected by the pandemic as about 55% of its stores are located in business process outsourcing (BPO) and commercial districts where employees were on work-from-home (WFH) arrangements during most parts of the year. Sales also declined during the imposition of the 10pm-5am curfew in NCR that started on March 15th to March 28th, followed by ECQ on March 29th, which resulted in -33.4% SSSG in the first quarter. SSSG steadily improved from the second to the fourth quarter to narrow down the full-year SSSG to -9.6%. Meanwhile, E-commerce as a percentage of total sales rose to 2.7% from 0.9% the previous year.

Gross margin and royalty income expanded to 35.4% in 2021 driven by the increase in commission income and distribution center (DC) allowance. Commissions from value-added services such as telco, bills payments, and cash-ins gained traction, accounting for 1.5% of sales from 0.9% in 2020.

EBITDA margins declined by 70bps to 5.9% in 2021 as OPEX grew with the conversion of several franchised stores

to direct.

As of year-end, Ministop had 456 store branches and provides online delivery services.

Specialty Stores

The specialty stores segment registered Php12.3 billion in sales in 2021. Sales declined by 7.4% due to the closure of the fashion segment and the reclassification of Growsari and No Brand to the supermarket segment.

SSSG showed tremendous progress, ending at 6.0%, a turnaround from the minus 28.0% it suffered in 2020. All specialty store formats contributed positive SSSG for the year. E-commerce sales also grew 63% and accounted for 3.0% of sales.

Blended gross margin rose by 400bps to 24.6% and EBITDA margins likewise expanded by 150bps to 7.9%.

The specialty stores portfolio totaled 288 as of end 2021. Robinsons Appliances and Savers Appliances have their own e-commerce websites — robinsonsappliances.com.ph and saversappliances.com.ph. Meanwhile, Shiseido joined GoRobinsons.ph in 2021. Toy ‘R’ Us also has Call & Collect and Call & Deliver services.