Chairman & President's

Message

Chairman

President and Chief Executive Officer

The Philippines had its share of economic wins and challenges in 2018. Marked by strong consumption and public investment, gross domestic product (GDP) growth was still one of the highest in the ASEAN at 6.2%, albeit a slowdown from the previous year’s rate of 6.7%.

OFW cash remittances grew by 3.1% to USD28.9 billion in 2018 while the business process outsourcing (BPO) industry contributed an estimated revenue of USD24 billion, and adding around 70,000 job opportunities in the sector. Tourism also reached an all-time high, with 7.1 million foreign arrivals or 7.6% increase year-on-year (y-o-y) and Php401 billion in tourism receipts.

However, inflation rose above the Bangko Sentral ng Pilipinas (BSP) targets causing consumer confidence to dip in the latter half of the year. Inflation was at its peak at 6.7% in September 2018, driven in part by the rise of global oil prices, and locally, the decline in the agriculture and fisheries sector due to unfavorable weather conditions. The latter adversely affected the supply of basic food commodities, most significantly resulting in steep increases in the price of rice, our primary staple. The trade deficit widened from the surge in imports of capital goods, mainly for government infrastructure projects, which contributed to the weakening of the Philippine peso.

ACQUISITION OF THE FOURTH LARGEST FOOD RETAILER

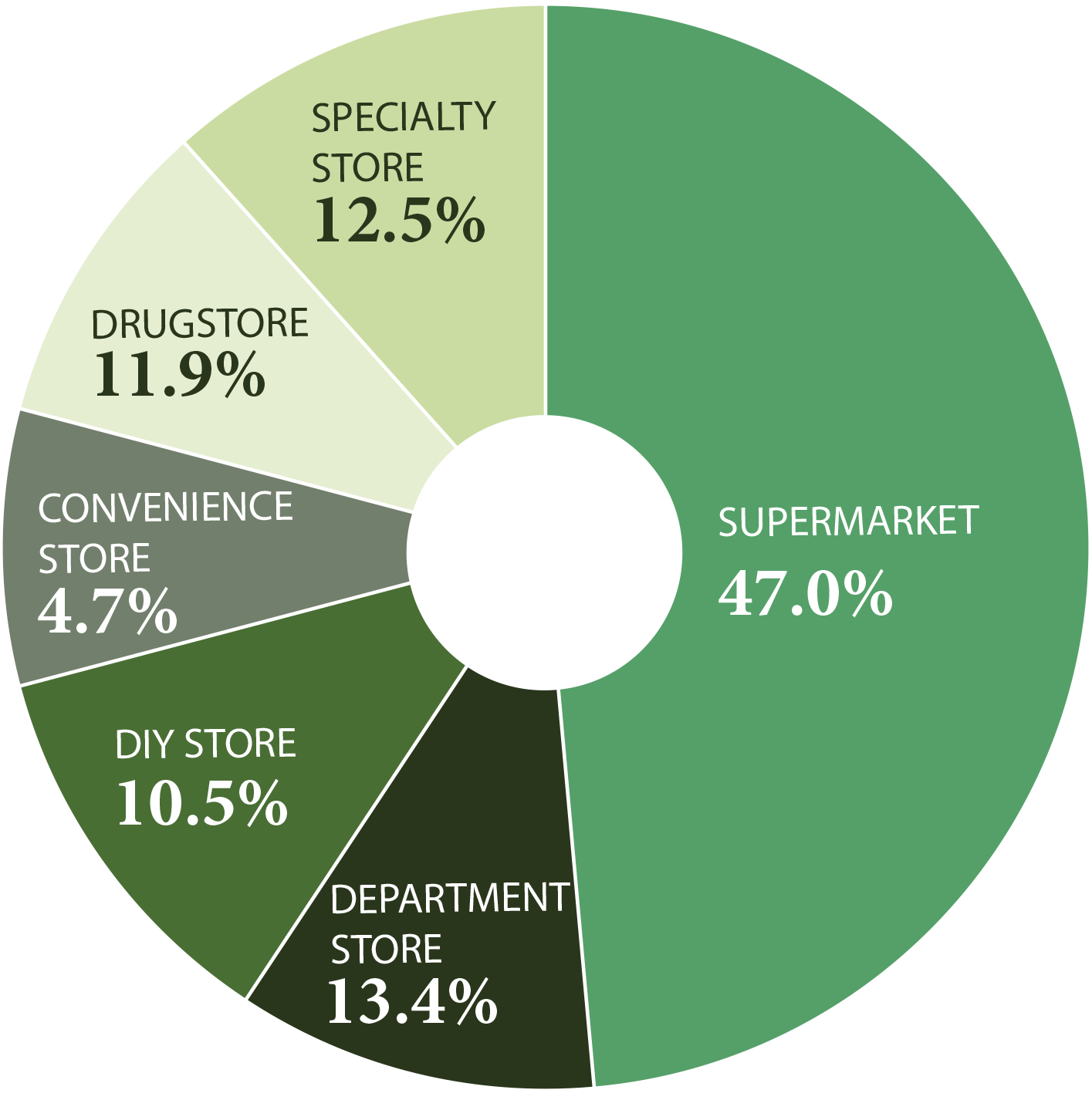

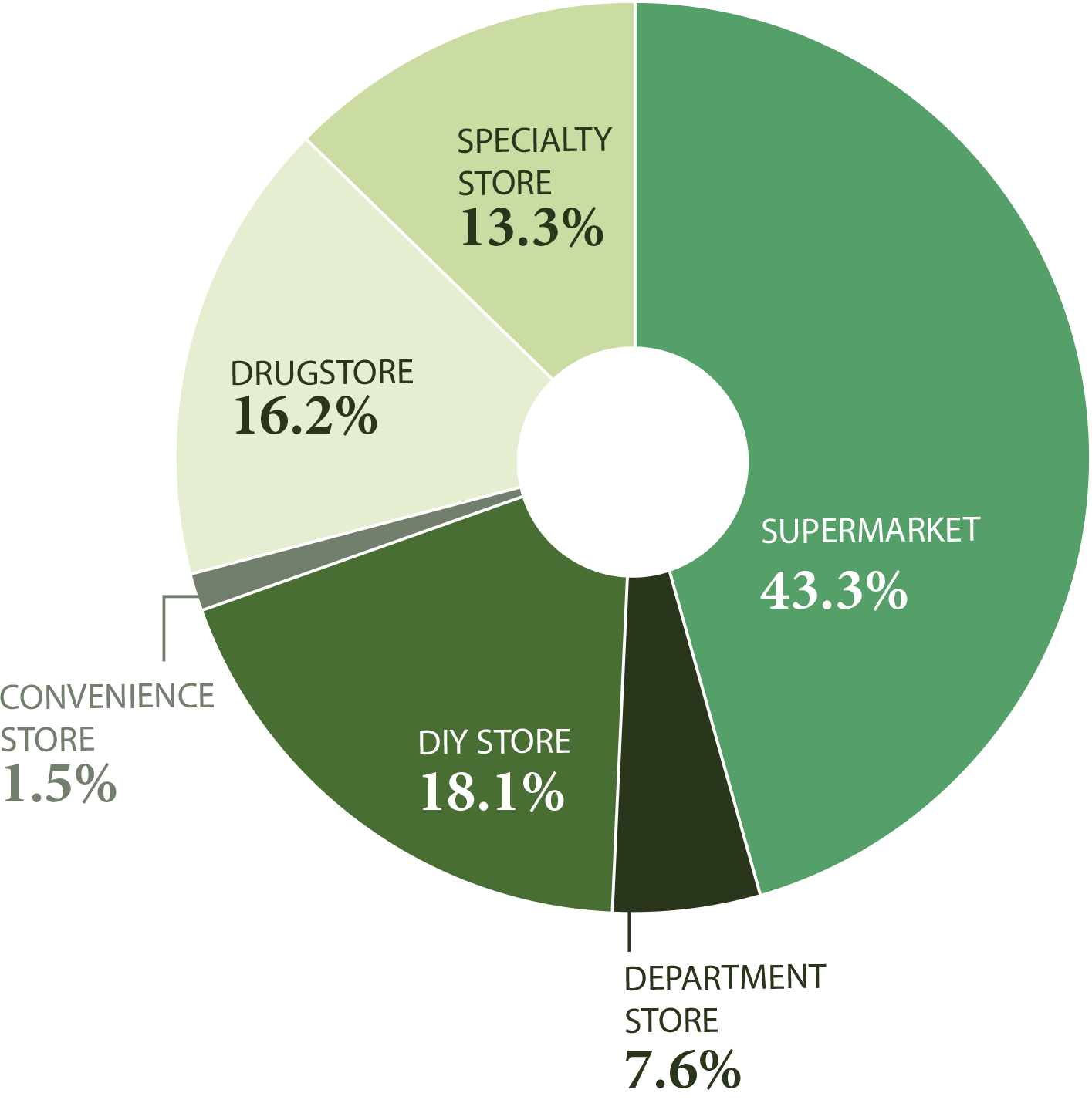

2018 was an exciting and game-changing year for Robinsons Retail. During the first quarter, we announced our agreement with leading pan-Asian retailer Dairy Farm International Holdings, Ltd. to acquire 100% stake in Rustan Supercenters, Inc. (RSCI) through a share-swap agreement. With Rustan being the country’s fourth largest food retailer, and valued at around Php18.0 billion, the transaction is Robinsons Retail’s biggest acquisition to date.

It was completed on November 23, 2018 after having undergone extensive assessment from the Philippine Competition Commission and the Securities and Exchange Commission. Combined with our supermarket business, we see avenues for synergies and alignment to become a stronger number three player through the experiences we have cultivated through the years, tapping into an even larger market from the expanding broad-middle to the upscale and affluent.

FINANCIAL PERFORMANCE

All aboard the TRAIN

Robinsons Retail Holdings, Inc. ended 2018 with consolidated net sales growing by 15.1% year-on-year from Php115.2 billion in 2017 to Php132.7 billion, including the December 2018 sales of Rustan’s. Strong same store sales growth (SSSG) was seen across all formats, which was at 5.9% on a blended basis from 2.7% in the previous year, driven by the almost perfect storm of the implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Law at the beginning of the year. Its provisions increased take-home pay for middle-income salaried workers, our company’s target market, which in turn boosted consumption on both staples and discretionary items.

SSSG of our supermarket segment significantly rose to 7.6% in 2018 from 2.5% in 2017, while our department store business reported a healthy 2.3% in 2018. Our convenience stores also grew by a strong SSSG of 5.1% from 2.9% in the previous year, while our drugstores showed a lift of 3.3% from 1.6%. SSSG in our Do-it-Yourself (DIY) and specialty stores segments remained robust at 5.0% and 6.9%, respectively, albeit softening from SSSG of 6.4% and 7.8%, respectively, in 2017.

The strength of data analytics capacitates us to explore more targeted approaches

Core net income rose 6.5% to Php5.0 billion in 2018 while net income attributable to equity holders of the parent company increased by 2.6% to Php5.1 billion. Blended gross margins rose 10 basis points (bps) to 22.5% on margin improvements in the supermarket and department store segments. Earnings before interests, taxes, depreciation and amortization (EBITDA) was up by 7.7% to Php9.0 billion, but EBITDA margin contracted by 50bps to 6.8% in 2018.

BUILDING THE RRHI STRATEGY HOUSE

Responding to the dynamic forces that affect the retail industry, we crafted the strategic foundations to set our goals for the next five years. We aim to maintain consistently robust SSSG at 3%-5% year-on-year, while being keen on growing our topline by mid to high teens to keep up with the growth rates among retail businesses in emerging economies.

Our strategic thrusts are outlined by five pillars, namely Data, Digitalization, Distribution, Disciplined Expansion, and Driven & Dedicated Workforce. In many ways, these areas cover cogent principles significant to corporations around the world, such as technology, operational efficiency, and sustainability. Together, they guide our journey in developing innovations that are essential for our formats to endure as relevant destinations to the Filipino market.

Data: The Power of Information

The day-to-day operations of retailing results into the constant influx of data from various touchpoints. From the products our customers buy and the promotions that engage them, to the narratives in social media that show insights into their culture as shoppers, we are able to understand the language of their consumption. In the future, we would be able to map out strategies within the supply chain and collaborate with our vendors, which we can do through enhanced data gathering and analytics tools.

As we added more participating brands into our loyalty program, in November 2018, we launched the Robinsons Rewards Mobile App, elevating our loyalty program onto the digital ecosystem. Through the platform, we can acquire new members who may register for free through their iOS and Android devices, while the existing 1.8 million members can simply scan the barcode at the back of their Robinsons Rewards card.

As of April 2019, over 120,000 members have registered through the mobile app. The strength of data analytics has capacitated us to explore more targeted approaches to offer products to our customers with the wealth of information we gather through the app. This in turn guides our management decisions and deepens our relationships with our customers.

Digitalization: The Foreseeable Norm

The inevitability of disruption is a reality corporations will have to respond to in one way or another; it is not a matter of whether or not new technology will arrive but how fast and how well we can keep up with it. Intimately connected to data, digitalization is one of the major pillars that profoundly impact retail through the lifestyles of the urban market. Tech-dependent Millennials currently dominate the labor force and are the lifeblood of growing e-commerce GMVs (gross merchandise value), while Generation Z is growing up with digital stimuli not present just half a generation before.

In Robinsons Retail, we have constantly embraced digitalization to complement instead of compete against our brick and mortar stores.

Our partnerships flourish with online marketplaces such as Lazada and Zalora, while we have pursued investments with new partners. In December 2017, we invested in Taste Central Curators Inc., operator BeautyMNL, the leading beauty e-commerce site in the Philippines today.

In September 2018, Robinsons Supermarket invested in a convertible note issued by Growsari Inc, a homegrown Filipino start-up that provides grocery delivery service to sari-sari store owners through a mobile app that aids in replenishing their supplies, a manifestation of the convergence between technology and inclusive business.

Distribution: Optimizing the Supply Chain

Greater efficiency is a constant goal for any business, with many industries around the world pursuing supply chain platforms with different levels of sophistication. The domain is both daunting and compelling.

In light of this, we have begun to explore opportunities in supply chain management and logistics which we can integrate in our operations. We want to be able to implement a cohesive and cost-effective strategy through partnerships and synergies with our vendors, as well as between our subsidiaries and across our distribution centers.

In June 2018, Robinsons Supermarket moved to a mega Distribution Center in Sucat, Parañaque. This 4.6 hectare distribution centeris equipped with case-picking and piece-picking systems which allow for better inventory management for both supermarket and minimart formats, and its size could support the volume of more than 250 stores as we continue organic expansion.

Disciplined Expansion: Organic Growth and Strategic Portfolio Expansion

Our primary key performance indicator is SSSG, so we maintain disciplined expansion as our approach in opening new stores. Locations are carefully assessed to mitigate the likelihood of store closures, as we aim for net store additions every year while maintaining profitability in older ones.

There is plenty of room to grow, as modern retail in the Philippines is still predictably most concentrated in highly urbanized areas in Metro Manila and regional centers in Visayas and Mindanao. Second-tier and third-tier cities outside the capital offer a considerable potential for organic growth, and historically, our brands served as pioneers for modern retail in frontiers such as these.

We give more options and experiences to people through continuously enhancing our merchandise selections in our present stores. By bringing in brands which we believe address the market’s desire for exploration and diversity, we further craft a curated portfolio for the holdings company.

On October 19, 2018, through an exclusive franchise agreement, we opened the first Philippine store for Pet Lovers Centre (PLC) in Robinsons Galleria, marking our entry into pet retail. Advocating responsible pet ownership and with a store locations across the Southeast Asia, Singapore’s PLC is a pet retail chain has built a legacy of providing quality pet products and services.

We also opened the first standalone store for Korean cosmetics line Club Clio in Robinsons Galleria, and two branches of Korean-inspired lifestyle and cosmetics store Arcova in Robinsons Pioneer and Robinsons Place Antipolo.

Driven & Dedicated Work Force: Talent and Commitment to Sustainability

Our relationship with people is inseparable from the DNA of our business and our take on corporate sustainability. We believe in delivering high quality customer service, growing our employees and their skills, and giving various avenues for learning and career development. We consider these as crucial elements in creating a fulfilling work environment where we not only acquire talent, but retain them because they understand that they are valued.

At end 2018, we had a personnel count of over 29,000 from diverse backgrounds as we strive to create an inclusive work environment. Seventy-four percent (74%) of our directly-hired workforce is female and 68% of upper-management positions are occupied by women. We have opened our doors to people with learning disabilities in our drugstore format, Southstar Drug, celebrating their capacities and empowering them through the social stigma they face.

As we expand into different cities and provinces, we employ people in the immediate localities and create a network of local suppliers when we can. Part of our operations is our engagement with small and medium enterprises, from vendors that work with smallhold farmers for organic produce, to third party truckers that support our logistics; in the process we are creating and distributing value across our supply chain. We are pleased that by the very nature of our expansion, we contribute to growing local economies and uplifting the standard of customer experience in places where we are present.

Community engagement continues to be a significant component of the business and we have maintained long-term partnerships with various organizations to achieve this across a multitude of platforms. We once again supported the University of the Philippines Men’s Basketball team, who, for the first time in 32 years, made it to the finals of the University Athletic Association of the Philippines (UAAP) Season 81 League. Our ties with Right Start Foundation, Hands On Manila, CRIBS Foundation, and various civil society organizations and corporate partners such Unilever and Mondelez remain strong, and working together, we aid in ensuring a safe and more secure society for Filipino children across the archipelago.

THE YEAR AHEAD

The Five D’s of our strategic framework were developed from a reflection of our past experiences balanced with the anticipation of relevant and emergent industry drivers. As we move forward, we intend to achieve the goals we have set by being nimble and discerning in the face of opportunities, from strategic mergers and acquisitions, to joint ventures, to innovative investments in tech.

The challenges of 2018 outlined areas in need of adaptive policies but the prospects area nonetheless optimistic. Inflation has softened to 5.1% by December 2018, and is expected to be within government targets in 2019.

Steps have been undertaken to lessen the price of basic commodities, such as legislation on rice tarrification and boosting supplies, and interest rates have been increased to curb inflation. Oil prices are also likely to normalize. These factors would benefit businesses by lowering the cost of production and boosting margins, while the slowdown of inflation would improve consumer confidence and raise private consumption. Further, the incoming May 2019 elections would post higher consumption by raising disposable income as well as employment.

The Philippines is likely to remain one of the fast-growing economies in Southeast Asia and the Pacific. GDP is expected to grow by 6.3% and accelerate by close to 7.0%, primarily driven by government’s infrastructure outlays and mid-term election-related spending.

Likewise, investment is seen to increase due to the Build, Build, Build projects of the administration, such as the planned subway and airport project in Metro Manila. Overall, these indicators tell us that the Philippine macroeconomic environment is encouraging for the consumer and retail sector, which would allow companies like ours to attain higher trajectories of growth.

Acknowledgments

As always, we extend our gratitude to all the people and institutions who are part of our continuing journey as a company. The narrative of Robinsons Retail is written with the trust we have built with our consumers, the dedication of our employees and management, and our collaborations with our multitude of partners. Unfailingly delighted by our stores and our products, we hope to be with you in the years ahead.

Happy Shopping!

Chairman

President and Chief Executive Officer